A Condo Crisis? Toronto's Unsold Units Raise Alarms in the Real Estate Market

2024-10-09

Author: Emily

Toronto's Real Estate Market Overview

Toronto's condo market is facing a dire situation as sales of new and yet-to-be-built condominiums have plummeted to their lowest levels in decades. However, what's even more alarming is the growing concern over thousands of completed or nearly completed unsold apartments and townhouses that are currently multiplying in the region.

Current Statistics and Industry Insights

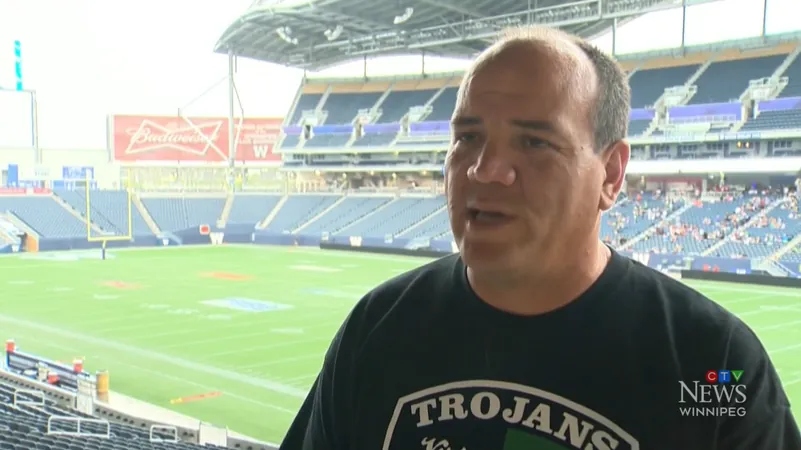

Fraser Wilson, a former senior vice-president at International Home Marketing Group, reveals a staggering statistic: “You’ve got almost 96,000 units under construction, set for completion and delivery over the next three years in the Toronto area.” Traditionally, approximately 20% of these units would remain unsold upon project launches between 2018 and 2022. Now, however, many industry insiders seem to indicate that the number of unsold units is on the rise as buyers increasingly withdraw from their purchase agreements.

Buyers Withdrawal and Developer Challenges

“Developers are beginning to see more customers throwing in the towel, stating, ‘I can’t close on this unit. Keep my deposit, I will take legal action,’” Wilson points out. This warning signals a deepening crisis in the real estate market that could have far-reaching economic repercussions.

The Legal and Financial Framework

The pain in the market isn’t just felt by the buyers. Lawyer Mark Morris has noted a growing influx of clients seeking solutions to avoid defaulting on contracts, which often come with heavy financial penalties. In his view, we are currently entrenched in the "pain cycle" of a real estate correction where everyone—buyers, builders, and lenders—faces losses.

Impact on Builders and Lenders

Although lenders currently seem to have a cushion against significant losses, builders are feeling the pinch. Morris states, “Builder pain is becoming quite acute; they’re facing increased defaults and are attempting to preempt this by ensuring they have proof of financing.”

Rising Interest Rates and Its Effects

Analysts believe this pain escalated with the rapid rise in interest rates, which inflated existing mortgage costs and stifled the assignment market—an avenue where buyers used to swap contracts for preconstruction units. Over the past two years, as the slowdown became more pronounced with builders delivering completed units, the question has been: how can these developers now cope with plummeting resale prices?

Varied Strategies Among Real Estate Companies

For real estate companies, the strategies vary widely. One prominent player, CentreCourt Developments, has taken an aggressive approach, filing over 40 claims in Toronto's civil courts against preconstruction buyers who have defaulted. For instance, a recent claim involved a buyer who pulled out of a $534,767 agreement for a 32nd-floor unit at 199 Church St., just as the unit's price was adjusted upward.

Listings and Market Conditions

According to current listings, similar units are languishing on the market. For example, a comparable unit sold for nearly $1,183 per square foot over the summer, while another unit priced higher at $1,358 per square foot remained unsold for 142 days before the listing ultimately ended.

Legal Actions and Builder's Strategy

While legal action against buyers is not yet commonplace, Morris cautions that builders are biding their time, able to sue for up to two years post-loss without having to rush their decision. This demonstrates a strategic patience in the face of rising unsold inventory.

Proposed Solutions to Revive the Market

Amidst such challenges, a solution is being proposed to revive the market. Wilson has launched a new auction site—www.inventorycondos.com—to help buyers and builders correctly gauge the real market price of these unsold units. It may lead to some losses for builders, but it also holds the potential to rebalance the market.

Market Outlook and Future Considerations

“We need to meet in the middle,” Wilson asserts. His auction initiative is centered around moving unsold inventory efficiently, highlighting that some recently completed units are still being marketed at inflated prices, far beyond what the current resale market can afford. As the unease continues to permeate the market, this innovation may be crucial in bringing clarity and revitalizing Toronto's beleaguered condominium sector.

Conclusion and Future Prospects

With such significant shifts on the horizon, stakeholders across the board are left wondering: how long can Toronto's condo market endure this turmoil before major reforms become necessary? Will the auction initiative succeed, or is the market setting itself up for an even bigger crash? Stay tuned as we continue to follow this unfolding story.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)