A Mortgage Tsunami Approaches: How Canadians Are Bracing for the 2025 Renewal Crisis

2025-01-07

Author: Liam

Introduction

Canada is on the precipice of a significant financial upheaval as over 1.2 million homeowners prepare for mortgage renewals in 2025. Many of these individuals, like Alecia from Horseshoe Valley, Ontario, are grappling with the daunting prospect of ballooning payments. Alecia lamented, “We have no idea how we will afford an increase,” highlighting that it's not just the mortgage; rising property taxes and living costs are contributing to her anxiety.

The Impact of Rising Interest Rates

A staggering 85% of current mortgages were contracted when interest rates hovered around 1%, meaning a relentless wave of "payment shock" is imminent. The Bank of Canada has made efforts to tame inflation by hiking interest rates to a 22-year high, only to have recently cut them by 175 basis points. However, for many Canadians, this drop may still not be enough to alleviate the financial strain they face when renewing.

Individual Stories: Maria's Dilemma

Take the case of Maria from Tottenham, Ontario. With a $585,000 mortgage at a low rate of just 1.9%, she now confronts potential new rates starting at 3.99%. This shift could lead to a monthly payment increase of at least $700, forcing her to consider extending her amortization period and switching from bi-weekly to monthly payments—essentially delaying her journey to homeownership.

Rising Delinquency Rates

The Canadian Mortgage and Housing Corporation (CMHC) is forecasting a rising tide of mortgage arrears, as the delinquency rate has already begun to climb. In the second quarter of 2024, the national mortgage delinquency rate reached 0.192%, with particular concern in Toronto, where rates could spike to levels not seen since 2012. Increased financial strain is expected not just for mortgage holders but also for those with auto loans and credit cards, with delinquency rates on the rise across the board.

The Resilience of Canadians

Despite these grim forecasts, experts suggest a catastrophic wave of defaults and foreclosures is unlikely. Peter Routledge, Superintendent of Financial Institutions, noted that Canadians have historically shown resilience during financial strains. Similarly, Tania Bourassa-Ochoa from CMHC anticipates that most homeowners will find ways to adapt rather than defaulting outright.

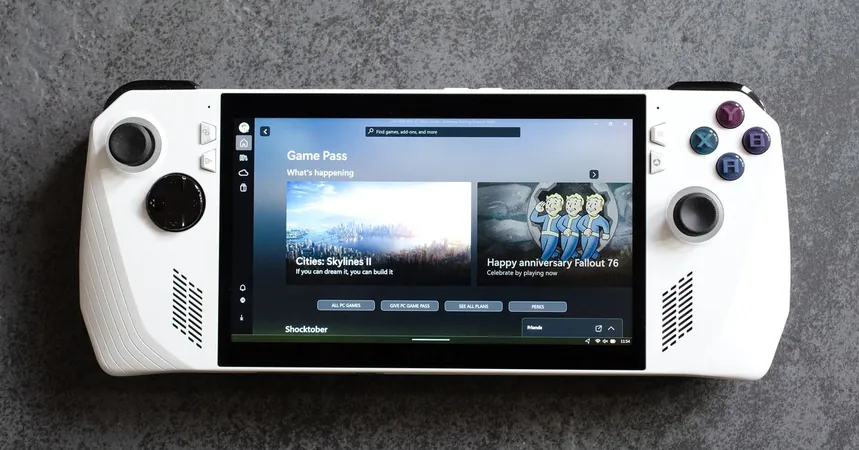

Preparing for Renewal

As the 2025 mortgage renewal date looms, savvy homeowners are keen to secure the best rates. Financial experts from Ratehub.ca stress the importance of doing thorough market research instead of relying on existing lenders. Financial institutions are preparing to compete aggressively for business, meaning homeowners must be proactive to avoid the common pitfall of simply signing the renewal documents without negotiation.

Fixed vs. Variable Rates

Whether homeowners should opt for fixed or variable rates remains a personal decision, hinging on individual risk tolerance and market conditions. While variable rates may trend lower as the Bank of Canada continues adjusting its policies, fixed rates could be less predictable, influenced by a myriad of global factors including potential tariffs and economic policies in the U.S.

Conclusion

The upcoming wave of mortgage renewals, coupled with rising living costs and inflationary pressures, spells a challenging financial landscape for many Canadians. Homeowners would do well to stay informed, seek out competitive rates, and plan strategically to navigate this impending crisis. Will you take the plunge now or wait for the storm to pass? The choice could reshape your financial future.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)