Bank of Canada’s Mendes Warns: Price Drops Could Spell Trouble for Canadians!

2024-11-27

Author: Liam

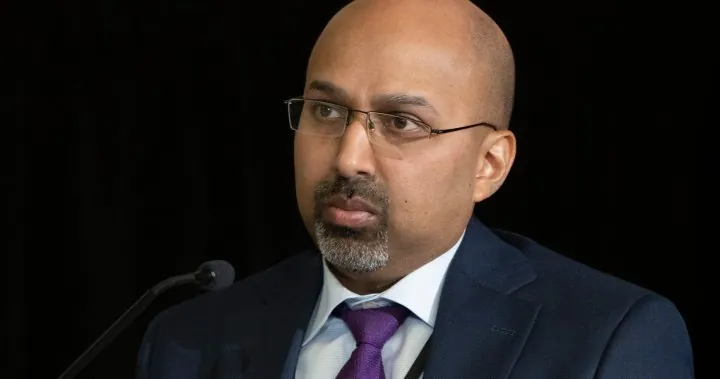

In a recent speech delivered in Charlottetown, Bank of Canada Deputy Governor Rhys Mendes cautioned that pursuing significant price drops could lead to more hardship for Canadians. Instead of bringing relief, such declines would necessitate harsher economic measures, including prolonged high interest rates, ultimately leading to greater financial distress for many households.

The Importance of Maintaining Inflation Target

Mendes emphasized the importance of maintaining the Bank's inflation target of two percent, citing that while a reduction in prices might appear beneficial on the surface, the ensuing challenges could outweigh the advantages. “It may seem counterintuitive,” Mendes explained, “but it would be painful for many Canadians if we were to try to bring about a period of price declines.”

The Risks of a Deflationary Environment

He elaborated on how a deflationary environment could trap consumers in a cycle of delayed spending, contributing to a downturn where businesses might be forced to lower their prices further. This would create a feedback loop, where expectations of falling prices lead consumers to postpone purchases even more, which in turn drives prices down further—an economic spiral that is notoriously difficult to recover from.

Current Economic Conditions

Despite the Bank of Canada recently celebrating what it considered a victory over high inflation with rates dropping to around two percent in October, many Canadians continue to feel the pinch of rising living costs. Mendes acknowledged that wage growth has not kept pace with inflation for everyone, pointing out the inherent limitations of monetary policy in addressing such disparities.

Political Ramifications and Government Measures

Amidst the ongoing pressures, political ramifications are brewing. The Liberal government, facing criticism for rising prices, has announced measures to alleviate some of the financial strain. Prime Minister Justin Trudeau revealed a plan to implement a two-month Goods and Services Tax (GST) break on various essentials starting December 14. Additionally, the government is distributing $250 checks to Canadians with an income of up to $150,000 who worked in 2023.

Conclusion

As the Bank of Canada navigates these turbulent economic waters, Mendes concluded that staying the course and keeping inflation within target is crucial. “Keeping inflation at the two percent target mitigates these risks,” he stated, highlighting the delicate balance the central bank must maintain to ensure economic stability moving forward.

Stay tuned as we continue to monitor how these economic policies unfold and their effects on Canadians’ daily lives. Are we on the brink of a new economic struggle, or can the government effectively alleviate the financial burdens facing many?

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)