Canadians Rejoice as Trudeau Announces Temporary Tax Relief for Essential Goods and Holiday Cheer

2024-11-21

Author: William

Introduction

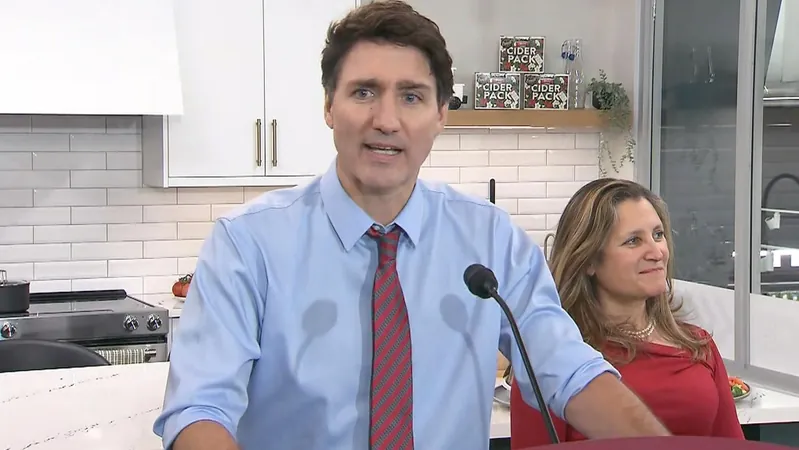

In a much-anticipated move to alleviate financial burdens, Prime Minister Justin Trudeau has unveiled a temporary tax relief initiative aimed at essential items, children’s clothing, and even holiday stocking stuffers. This announcement, made on Thursday, is designed to target the ongoing affordability challenges many Canadians face.

Details of the Tax Relief

Starting December 14 and lasting until February 15, residents across the country will benefit from a two-month exemption on the Goods and Services Tax (GST) and Harmonized Sales Tax (HST) for a variety of goods. This relief initiative comes as a response to the economic hardships many families have endured over the past few years.

Prime Minister's Statement

"Canadians have been through a lot," Trudeau stated. "They work hard. We see that. We've been able to get through the past couple of years. Now, we’re stepping up to ease their burden with this tax break."

Qualifying Items

The range of qualifying items for tax relief includes prepared salads, sandwiches, cakes, pastries, restaurant meals whether dine-in or takeout, and even indulgent treats like ice cream and chocolates. Items specifically aimed at children, such as clothing and diapers, will also see tax discounts during this period. Notably, toy favorites like Lego and action figures will be included, ensuring holiday shopping is a little lighter on the wallet this season.

Introduction of the Working Canadians Rebate

In addition to the tax break, Trudeau and Deputy Prime Minister Chrystia Freeland announced the introduction of a "Working Canadians Rebate," which is set to deliver a one-time payment of $250 to approximately 18.7 million Canadians in early spring 2025. This initiative is expected to provide additional relief to those looking to recover from rising costs.

Economic Impact

The federal government estimates that the temporary tax relief will cost around $1.6 billion, translating to a potential $100 savings for a family that spends $2,000 on qualifying goods during the designated period.

Political Reactions

However, the announcement has not come without political drama. The New Democratic Party (NDP), led by Jagmeet Singh, has taken some credit for this temporary relief measure. Singh has long advocated for the elimination of GST on daily essentials and is set to debate the implications of this announcement. As the debate heats up, the measures will require legislative approval, meaning cooperation will be needed in the House of Commons to move forward.

Future Considerations

Given the current political gridlock concerning other crucial issues, including a controversial green tech fund, it remains to be seen how quickly this tax relief can be enacted. Trudeau expressed hope for collaboration among all parties to expedite the approval process, aiming for Canadians to see tangible benefits beginning December 14.

Conclusion

As the holiday season approaches and affordability remains a pressing concern, this tax relief initiative and rebate program stand to provide welcome support for many households across Canada. Stay tuned for updates as this story develops, and be prepared to fill your shopping carts without the weight of tax adding to the cost!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)