Findlay Park Fund Ditches Tech Giants Amid Market Fluctuations

2024-10-08

Author: Amelia

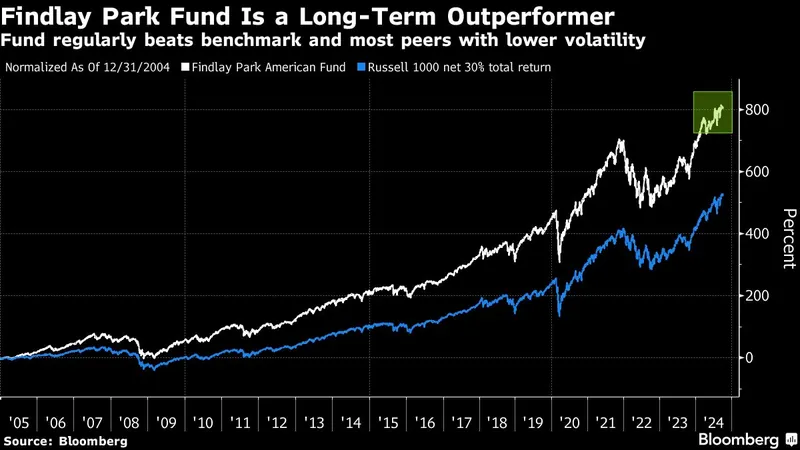

Findlay Park Partners LLP, a high-performing fund managing around $11.3 billion, has made waves in the investment community by trimming its holdings in major technology stocks that propelled this year's US stock market rally. Surprisingly, the fund has outperformed a staggering 86% of its peers, boasting returns of approximately 29% over the past year.

In a recent client note reviewed by Bloomberg News, Findlay Park disclosed that it completely eliminated its stake in Nvidia Corp., a key player in the AI revolution. Once accounting for 5% of the fund’s portfolio, Nvidia saw a share price decline during the third quarter. Meanwhile, holdings in UnitedHealth Group Inc. and Accenture Plc surged by over 15%, indicating a strategic shift in investment focus.

The fund also decreased its investment in Microsoft Corp, its largest position for many years, cutting it down from 4.8% in August to just 3% by the end of September. Simon Pryke, the CEO of Findlay Park, commented on the challenges facing the so-called "Magnificent Seven" tech stocks, saying, “The earnings growth expectations are pretty tepid, and valuations continue to anticipate growth that may not materialize.”

Despite the wavering enthusiasm for big tech, analysts maintain an optimistic outlook for the sector. The S&P 500 Information Technology Index, which includes tech titans like Apple and Microsoft, is expected to rise approximately 14% over the next year, reaching around 4,962 points.

The fund focuses heavily on investments that have strong ties to the domestic US market, avoiding high-profile names like Tesla and Apple altogether. Interestingly, about 40% of its portfolio is allocated to companies with market capitalizations between $5 billion and $50 billion. Pryke noted the fund's preference for business-to-business enterprises, citing their typically capital-light operations, high recurring revenues, and strong cash flow generation as attractive qualities.

As broader market gains began to shift from large-cap technology to smaller stocks, investors are beginning to reassess the return on investments in artificial intelligence, especially in light of expected slower earnings growth among leading tech stocks. Analysts project a drop in growth for the Magnificent Seven from 36% in the last quarter to about 18% for the July-September timeframe.

While the future demand for AI remains a hot topic, Findlay Park's bold moves signal a strategic pivot that reflects caution in a volatile market landscape dominated by a few major players. Whether this approach pays off remains to be seen, but it certainly adds a layer of intrigue to the ongoing investment narrative.

As the tech industry faces significant scrutiny and market dynamics evolve, investors will be keenly watching how funds like Findlay Park navigate this transition and if their strategies will set new trends in the investment world.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)