Inside Canada’s ‘Valley of Death’: The Struggles and Solutions for Emerging Critical Minerals Miners

2024-11-22

Author: Amelia

Martin Turenne, the CEO of FPX Nickel Corp., represents a resilient spirit amid the daunting challenges facing Canada’s emerging critical minerals miners. In an industry where timelines stretch painfully long and chances of success are slim, Turenne remains hopeful about FPX Nickel's Baptiste project in central British Columbia. The ambitious goal is to get a nickel mine and refinery operational by the decade’s end—an essential step in fulfilling the demand from Canada’s burgeoning electric vehicle (EV) battery sector. However, the projected costs for this massive undertaking reach an estimated $2.6 billion.

Before any actual mining operations commence, FPX will need to complete a multitude of preparatory tasks, including further drilling, conducting feasibility studies, undergoing environmental assessments, and engaging with local First Nations communities. To secure the $45 million needed to support these initial steps, the company is vying for investor interest—an increasingly challenging endeavor given its current lack of revenue and a depressed share price.

The landscape for raising capital in Canada’s junior mining sector has become increasingly hostile, especially following Ottawa's recent restrictions against raising funds from Chinese state-owned enterprises—once a critical source of investment. This policy aims to reduce Canada’s reliance on China, which currently dominates the global supply chains of electric battery minerals. However, Turenne acknowledges that cutting off such funding sources in an already capital-starved industry significantly hampers FPX’s chances of survival.

A stark comparison reveals the contrast in funding over the years—Canadian junior miners raised $2 billion in 2021, a dismal figure compared to the $6.2 billion peak in 2009. With the 2022 clampdown, that number has plummeted to a mere $400 million mid-year, leaving companies like FPX in desperate need of financial backing.

Canada faces a precarious situation; while EV battery plants are proliferating within its borders due to government support, the raw materials for these facilities are likely to be sourced from regions with lax environmental standards, countering Canada's stringent regulations. Turenne points out the irony, highlighting the hypocrisy in promoting responsible sourcing while neglecting local opportunities to produce sustainably sourced materials.

In a trend that highlights the dire circumstances, several Canadian critical minerals companies are relocating overseas to seek capital. For instance, SRG Mining, now known as Falcon Energy Materials PLC, left Canada for the UAE to tap into larger pools of investment, turning away from federal regulations. Similarly, Solaris Resources announced its move to Ecuador after being denied a financing agreement with a Chinese company.

Christopher Ecclestone, a mining strategist at Hallgarten & Co., believes that many junior mining companies will now avoid governmental oversight entirely, looking to partner swiftly with Chinese investors abroad to circumvent capital restrictions. This pattern significantly diminishes Canada’s competitive edge in the critical minerals sector.

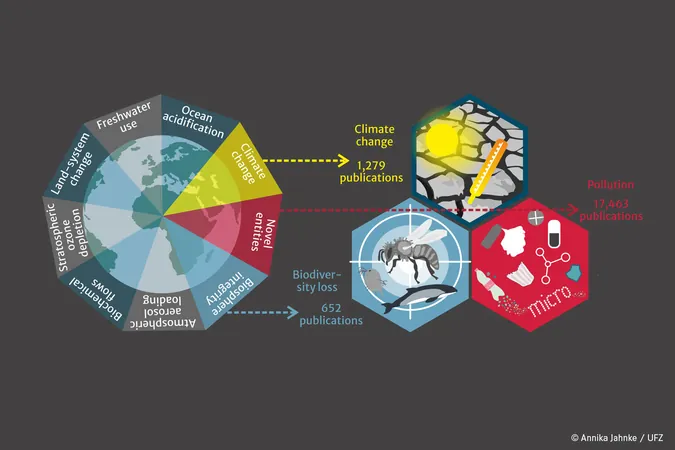

Despite Ottawa's increased financial backing for early-stage exploration and late-stage development mining projects, FPX and others in the challenging mid-stage development find themselves overlooked. The Lassonde Curve illustrates this precarious phase known as "The Valley of Death"—a daunting period that many junior miners never survive.

Companies like Canada Nickel, which are pushing through similar struggles, are developing notable projects like the Crawford nickel-cobalt site, projected to become a major contributor to the Western world's nickel supply post-production. However, the longer it takes to navigate regulatory hurdles, the further Canada risks falling behind global competitors.

The federal government acknowledges a lengthy permitting process, at times stretching to 25 years, and has pledged to streamline these bureaucratic obstacles. Yet, the road remains rocky for mid-stage projects, which require thoughtful trade measures and enhanced capital access to stay afloat.

Notably, strategic investments from larger corporations like Anglo American and Agnico Eagle have proved beneficial, though they are still far fewer compared to past years. Governments and strategic partners must evolve their approaches to ensure Canada capitalizes on its critical mineral wealth, while also setting clear and coherent policies that genuinely prioritize sustainable sourcing.

As the industry grapples with its internal failings and external pressures, the next moves are crucial. Can Canada navigate this "Valley of Death" effectively, or will it succumb to the pressures of global competitors eager to exploit its untapped potential? Solutions must emerge rapidly if the country is to exploit its vast natural resources and lead in critical minerals for a sustainable future.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)