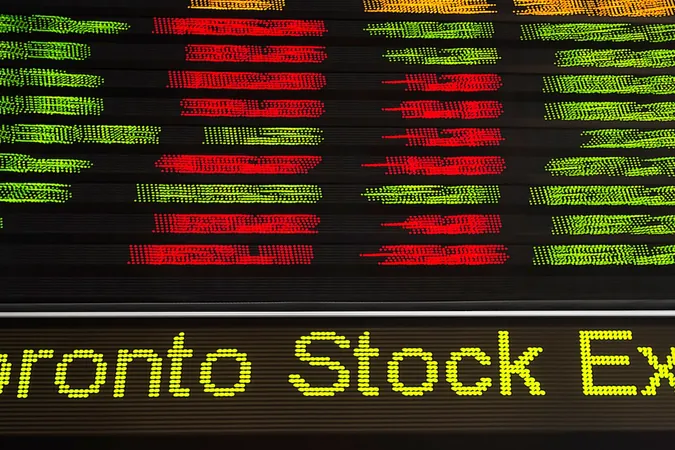

Major Changes on the Horizon: Four Stocks Enter Canada's S&P/TSX Composite Index!

2024-12-09

Author: William

Introduction

In a significant update to Canada's financial landscape, S&P Dow Jones Indices has announced the addition of four new stocks to the S&P/TSX Composite Index, which serves as the primary benchmark for the Canadian equity market. This change will take effect with the market opening on December 23. Interestingly, no stocks are being dropped as part of this adjustment, subsequently leaving the composition of the S&P/TSX 60 unchanged. This index represents the country's largest companies, and despite analyst speculation about potential removals, Algonquin Power and Utilities Corp. remains firmly within the index.

New Entrants

The new entrants to the index are: - **Aecon Group Inc. (ARE-T)**, a notable player in the construction sector, - **Enerflex Ltd. (EFX-T)**, specializing in energy services, - **TerraVest Industries Inc. (TVK-T)**, also in the energy field, and - **Ngex Minerals Ltd. (NGEX-T)**, a Vancouver-based company focused on the mining of precious metals in South America.

Underlying Trends

The addition of these companies reflects ongoing trends in Canada’s evolving investment landscape, particularly in construction and energy, sectors poised for growth as the country moves toward sustainable practices and infrastructure improvements.

Analyst Speculations

Analysts had speculated that Algonquin Power, which recently sold its renewable energy business for a substantial $2.5 billion to reduce debt, could be at risk of being replaced, with Fairfax Financial Holdings Ltd. (FFH-T) considered the most likely alternative. After shedding a considerable part of its operations, Algonquin has faced scrutiny regarding its position within the prestigious S&P/TSX 60.

Criteria for Inclusion

Understanding the criteria for inclusion in these indices is crucial for investors. S&P Dow Jones Indices evaluates companies based on their "float," or the portion of shares available for public trading, excluding those held by insiders. For a company to qualify for the Composite, their float-adjusted market capitalization must represent at least 0.04% of the total value of the index. Conversely, to maintain their status, companies must not fall below 0.025% of the index's value.

Market Impact

The impact of being included in or removed from a major index can be substantial, particularly in the context of rising index funds and passive investment strategies. As this shift takes place, companies added to the Composite typically experience a boost in share price due to increased demand from fund managers required to hold elements of the index. According to research by Morningstar Direct for The Globe and Mail, Canadian mutual funds and ETFs managing approximately $395 billion have demonstrated a 95% correlation to the S&P/TSX Composite over the last year, highlighting the profound influence of index status on market performance.

Demand Estimates

ATB Securities Inc. analysts have estimated that the demand linked to index inclusion constitutes an average of 5.5% of the float for companies within the S&P/TSX Composite. This emphasizes the critical role that index membership plays in shaping investment strategies and market dynamics.

Conclusion

As investors brace for the upcoming changes, the question remains: Will these newly added stocks surge, and how will Algonquin Power maneuver within this shifting financial landscape? Keep an eye on the market – exciting times are ahead!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)