Nvidia's Stock Dips as AI Spending Concerns and Fierce Competition Loom

2024-12-17

Author: Jacob

Nvidia's Stock Takes a Hit

Nvidia (NVDA) shares took a hit early Tuesday, plunging more than 2% as investors expressed newfound caution regarding the artificial intelligence (AI) spending that has previously driven the stock's impressive growth. Currently, Nvidia's stock sits approximately 14% below its peak closing price of $148.88, which was achieved in early November.

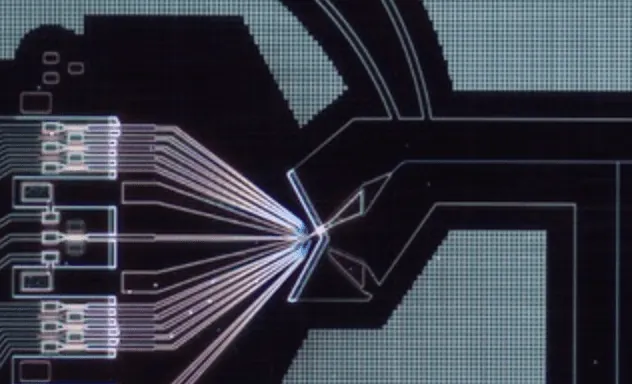

Transition to AI Chips

Once a powerhouse primarily recognized for its graphics cards used in gaming, Nvidia has rapidly transformed into the leading supplier of AI chips amidst a sector-wide shift toward generative artificial intelligence. This year, the company has even outperformed Apple (AAPL) to become the world’s most valuable company and has recently replaced Intel (INTC) in the Dow Jones Industrial Average. Analyst Dan Ives from Wedbush predicts that Nvidia's market capitalization could soar to over $4 trillion by 2025.

Concerns Amidst Slower AI Investments

However, the air has shifted since November, when Nvidia's stock reached its zenith. Recent comments from tech giants Microsoft (MSFT) and Google (GOOG) suggested that their investments in AI are expected to grow at a slower rate moving forward, instigating concerns among investors. Compounding the situation were rumors surrounding Nvidia's latest Blackwell AI servers overheating, raising fears about potential delays in scaling production. Even a stellar earnings report that surpassed optimistic analyst projections failed to buoy the stock's momentum.

Regulatory Scrutiny and Competition

Adding to Nvidia's woes is the initiation of an antitrust investigation by China’s competition authority into its $7 billion acquisition of networking technology company Mellanox. This news adds a layer of regulatory scrutiny that could hinder Nvidia's operational strategies in one of its key markets.

Emerging Competitors

As competition intensifies, other players are stepping up to challenge Nvidia's dominance. Amazon (AMZN) recently announced its plans to develop a supercomputer utilizing its new servers and proprietary Trainium AI chips, which it aims to position as a viable alternative to Nvidia's offerings. Furthermore, Broadcom (AVGO) stated in its latest earnings report that its agreements with hyperscalers to deliver custom AI chips, known as XPUs, could yield as much as $90 billion over the next three years. This development has led to a spike in Broadcom's stock while Nvidia’s fell even further, despite analysts suggesting that Broadcom's growth may not necessarily be at Nvidia's expense.

Market Reactions

On a broader scale, the PHLX Semiconductor Index (^SOX), which encompasses Nvidia and other semiconductor stocks, experienced a decline of nearly 2% on the same Tuesday. Investors seem to be bracing for shifts in an increasingly competitive landscape where AI technology continues to evolve at a rapid pace.

Conclusion

In a market where every move is scrutinized, investors are left pondering: Is this the beginning of the end for Nvidia's unmatched reign in the AI chip sector, or is it merely a bump in the road? Only time will reveal whether these concerns are truly warranted or if Nvidia can navigate these turbulent waters to maintain its leadership position in the AI revolution.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)