Oil Prices Flounder Despite Potential for Resurgence

2024-10-11

Author: Michael

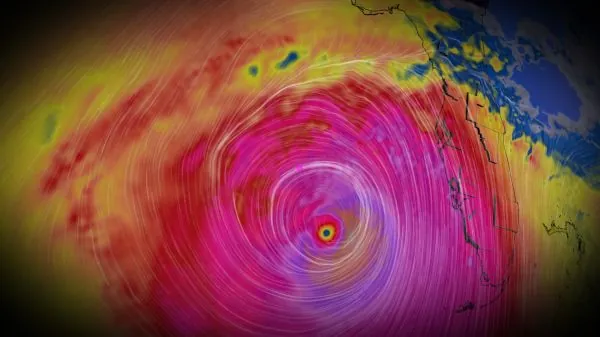

In recent days, the oil market has been tumultuous, primarily due to speculation surrounding a possible Israeli strike on Iranian oil infrastructure and fears of significant oil output disruptions caused by Hurricane Milton in the U.S. However, as the week wrapped up, the anticipated Israeli attack did not occur, and Hurricane Milton's effects on oil production appeared to be minimal.

As of October 11th, 2024, Brent crude futures dipped below the $79 per barrel threshold, influenced by market disappointment over unfulfilled military conflict expectations. While Hurricane Milton wreaked havoc in Florida, its repercussions on oil supply were minor, allowing economic factors to take center stage, particularly in light of a notable decline in U.S. inflation to an annual rate of 2.4%.

Oil majors have begun signaling a challenging third quarter, with a UK oil giant reporting a substantial $500 million drop in refining margins and declining performance in oil trading activities. Shell, another key player in the industry, reported a staggering 30% decrease in refining profit margins, which fell to $5.5 per barrel from $7.7 per barrel in the previous quarter.

Beyond oil, developments in the metal markets also caught attention, as copper prices experienced a slight uptick to $9,770 per metric tonne. Investors are eagerly awaiting more concrete policy directions on infrastructure investments from China's Finance Minister, Lan Foan.

In another development, ExxonMobil announced the acquisition of over 271,000 acres in Texas state waters for an offshore CO2 capture project, enhancing its investments in sustainable energy.

On the geopolitical front, Yemen's Houthi rebels recently targeted Russian tankers, including the Olympic Spirit, with missile attacks, highlighting ongoing tensions in the region.

In the mining sector, Australian giant Rio Tinto confirmed its acquisition of Arcadium Lithium in a dramatic $6.7 billion cash deal, positioning itself as a leading lithium producer worldwide.

Moreover, East Timor is in negotiations with Chinese companies, including Sinopec, to kickstart its upstream oil and gas projects, particularly in the Greater Sunrise gas field rich in natural gas reserves.

In a cautionary note, JPMorgan has warned that mining stocks may see a significant decline of up to 20% in valuations, should new U.S. tariffs be enacted after the upcoming presidential election, reminiscent of previous economic shocks.

Libya has made strides in restoring its oil production, reaching 1.22 million barrels per day, regaining output levels from prior to its recent crises.

In Mexico, a proposed bill passed the lower house of Congress aims to reinforce government control over the state-owned oil producer Pemex, transitioning it into a public company focused primarily on social objectives rather than profit margins.

In the U.S., Shell faced a setback with federal regulators denying its request for access to confidential documents related to Venture Global's Calcasieu Pass LNG facility, indicating the complexities of obtaining contract cargoes from the venture.

Nigeria has implemented its strategy of removing costly fuel subsidies, with the state-owned NNPC raising gasoline prices by over 15%, now selling fuel at market rates.

Finally, China is investing heavily in coal-to-liquids technology with a $24 billion project underway, while Malaysia is exploring the launch of pioneering futures contracts for used cooking oil, seeking to solidify its position in the biodiesel market.

As the landscape of the global oil and commodity markets continues to shift, stakeholders must remain vigilant for potential disruptions and opportunities that may arise.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)