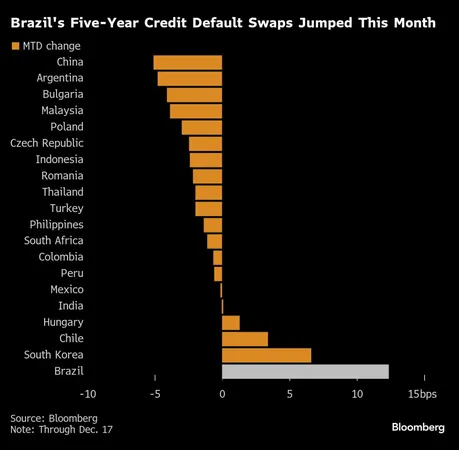

Panic Grips Brazilian Markets as Traders Embrace 'Sell First, Ask Later' Mentality

2024-12-18

Author: Amelia

Introduction

In a shocking turn of events, Brazilian financial markets have been engulfed in panic, prompting traders to adopt a 'sell first, ask later' strategy. This reaction has left investors reeling as they scramble to mitigate potential losses in a rapidly changing economic landscape.

Political Instability and Market Reaction

Reports indicate that ongoing political instability, exacerbated by recent scandals involving government officials, is driving uncertainty among traders. The Brazilian Real has taken a hit, trading at its lowest level against the US dollar in months, leading experts to warn of a cascade of sell-offs that could deepen the crisis.

Analysts' Perspectives

Analysts suggest that the prevailing worry over inflation and looming interest rate hikes are further compounding the anxiety in the markets. "We are witnessing a classic case of fear taking over rational decision-making," one analyst stated. "Investors no longer feel secure in holding onto their assets, leading to an avalanche of sell orders."

External Factors at Play

In addition to the political and economic turmoil, external factors such as fluctuating commodity prices and global economic concerns are adding to the overall uncertainty. Brazil, as a major exporter of agricultural products, is particularly susceptible to changes in international demand and pricing.

Outlook and Recommendations

While many are pinning their hopes on potential government intervention to stabilize the situation, the immediate outlook remains grim. Market experts recommend that investors exercise caution and focus on risk management strategies as they navigate these turbulent waters.

Conclusion

As the crisis unfolds, traders are left with more questions than answers: Will the Brazilian markets recover quickly, or is a deeper downturn on the horizon? Only time will tell, but for now, the prevailing sentiment is clear — panic sell-offs are dominating the day.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)