Robert Kiyosaki Accuses BlackRock of Manipulating Bitcoin Prices

2024-12-28

Author: Sophie

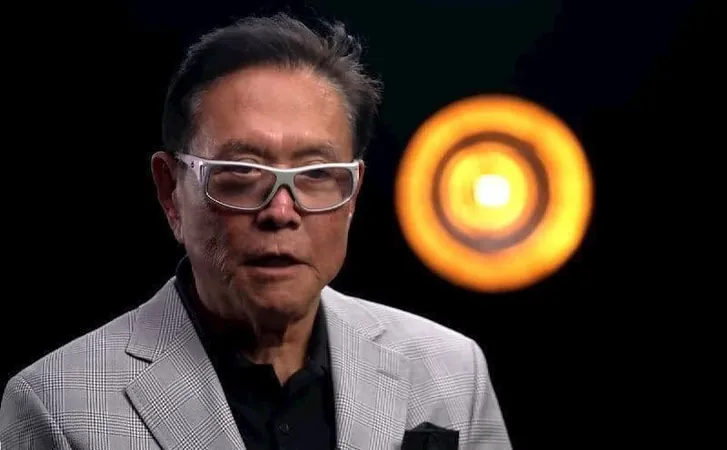

Bitcoin advocate and renowned author Robert Kiyosaki has put forth a provocative theory regarding the struggles of the cryptocurrency's price, currently hovering below the coveted $100,000 mark. Kiyosaki suggests that BlackRock, the largest asset management firm globally, is engaging in practices that he believes are intentionally suppressing Bitcoin's price to the detriment of retail investors.

In a recent post on social media, Kiyosaki claimed that BlackRock's CEO, Larry Fink, may be resorting to "dumping Bitcoin" as a strategy to allow institutional investors to acquire the cryptocurrency at reduced prices. Kiyosaki's concerns are underscored by BlackRock's significant involvement in the Bitcoin market, particularly following their launch of a spot exchange-traded fund (ETF) aimed at facilitating institutional investments in Bitcoin.

Kiyosaki, who has consistently criticized Bitcoin ETFs, emphasized that investors should prioritize keeping their Bitcoin in personal wallets instead of relying on large financial entities like BlackRock. He stated, "I love Bitcoin in my own wallet. I would not trust Bitcoin in BlackRock’s ETF," reinforcing the idea that such institutions might prioritize their financial maneuvers over the interests of individual investors.

Adding to the narrative, Kiyosaki referenced political comments made by former presidential candidate Vivek Ramaswamy, who has previously labeled Fink a "Marxist." Ramaswamy's remarks highlighted the ongoing debate between stakeholder capitalism, as promoted by BlackRock, and traditional shareholder capitalism, which he argues better supports individual investor interests.

Kiyosaki's accusations come on the heels of notable volatility within BlackRock's Bitcoin ETF, notably witnessing its largest single-day outflow of $188.7 million just days prior. This massive reduction in investment has sparked speculation regarding BlackRock's potential moves in the Bitcoin market, especially after the firm transferred a substantial 828 BTC – valued around $80 million – to Coinbase recently.

Despite these tumultuous elements, Kiyosaki remains remarkably optimistic about Bitcoin's future. He predicts a meteoric rise for the cryptocurrency, forecasting it could reach an astonishing $350,000 by 2025. Even amidst current price corrections, he encourages investors not to be disheartened, referring to complainers as "cry babies" and suggesting that downturns present prime opportunities for purchase.

As of now, Bitcoin is trading at approximately $94,545, reflecting a decrease of over 2% in the last 24 hours, while managing a slight gain of 0.8% over the past week. The cryptocurrency is grappling with potential challenges as the holiday season creates a testing ground for its stability. Analysts are closely monitoring price movements, particularly around critical support levels of $90,000, amid concerns that losing this threshold could lead to further selloffs and even a plummet to as low as $60,000.

With Kiyosaki’s controversial claims and the unfolding dynamics in the cryptocurrency market, investors are increasingly on alert regarding the implications of institutional involvement in Bitcoin's price fluctuations. Will Bitcoin rebound as Kiyosaki predicts, or will external factors continue to exert control over its trajectory? Only time will tell.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)