The Debt Ceiling Dilemma: What It Means for the US Economy

2024-12-21

Author: Liam

What Exactly is the Debt Ceiling?

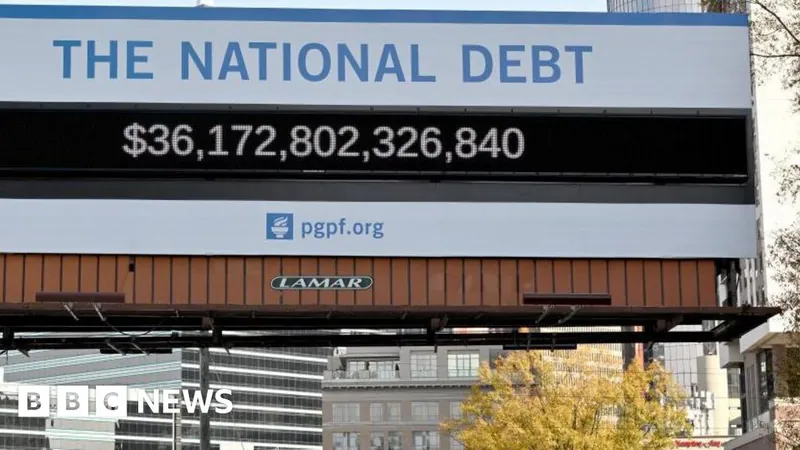

The debt ceiling is essentially a cap set by Congress on the amount of money the federal government is allowed to borrow. This borrowing is crucial for funding various essential services, including federal employee salaries, Social Security, Medicare, military operations, interest on national debt, and tax refunds. The debt ceiling has evolved significantly since its establishment in 1939, initially set at a mere $45 billion. Since then, it has been raised a staggering 103 times, with the most recent limit reaching $31.4 trillion in January 2023. In a significant development, Congress suspended the debt ceiling until January 1, 2025, due to a deal struck in June 2023. However, this respite did not quell the debates and concerns about government spending and fiscal responsibility.

What Happens When the Debt Ceiling Is Reached?

Hitting the debt ceiling results in the government being unable to borrow any additional funds. To meet its financial obligations, the government typically issues bonds – debt securities that promise repayment with interest. Once the ceiling is reached, however, the Treasury Department loses its ability to issue these securities, severely limiting cash flow into federal coffers. To navigate this crisis, the government can take emergency measures, including suspending planned investments in retirement and health benefit funds. While these measures can delay the inevitable for a few months, they do not provide a long-term solution and could potentially lead the country toward a catastrophic default. A default would have grave consequences for the US economy, requiring substantial cuts to salaries and benefits while hampering the government's ability to meet its financial commitments. Such an event would not only diminish the nation's credibility but could also weaken the dollar and dramatically increase borrowing costs.

Trump’s Stance on the Debt Ceiling

Former President Donald Trump has voiced his opinion on the matter, urging Congress to raise or even eliminate the debt ceiling as he aims for a potential return to the White House. On his Truth Social platform, Trump called for lawmakers to "get rid of, or extend out to perhaps 2029, the ridiculous debt ceiling." His proposed plan aims to fund federal agencies until mid-March of the following year while suspending the debt limit for an additional two years. Despite his push, this proposal faces staunch opposition from both Democratic lawmakers and fiscally conservative Republicans. Critics within Trump’s party argue vehemently against raising borrowing limits without concomitant reforms aimed at curbing government spending. Texas Representative Chip Roy expressed his discontent, stating, "I am absolutely sickened by a party that campaigns on fiscal responsibility."

The Stakes are High

As lawmakers continue to wrangle over the implications of the debt ceiling, the stakes have never been higher. The impasse risks not just a government shutdown but potentially unleashing a fiscal crisis with repercussions that could ripple through the global economy. Citizens are left wondering: will lawmakers put aside their differences before it's too late? The countdown is on.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)