Trump’s Economic Shifts: A Reversal of American Trade Principles

2025-04-05

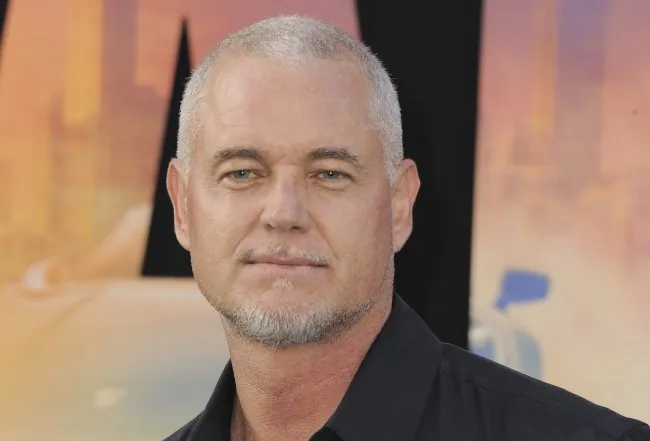

Author: William

In a surprising turn of events, President Donald Trump has chosen to impose extensive tariffs of at least 10% on nearly all imports into the United States, marking a significant shift from established economic practices that have underpinned America's growth for decades. This strategy appears to serve as a figurative wall aimed not at immigration but at protecting American jobs and industries by prioritizing domestic production.

The Historical Context of Tariffs

In his announcement, Trump invoked 1913—a pivotal year when the U.S. saw a drastic reduction in tariffs alongside the introduction of federal income tax. The ideology proposed by America’s first Treasury Secretary, Alexander Hamilton, rested on the belief that high tariffs were necessary for national prosperity. The current administration appears to endorse this view, interpreting past successes as evidence that tariffs can catalyze a revival of American manufacturing.

Counter to the global consensus built around free trade, particularly the principles outlined by 19th-century economist David Ricardo, the U.S. now appears reluctant to fully embrace comparative advantage—a theory arguing that countries prosper by specializing in goods they produce best and engaging in open trade.

Understanding the Rationale Behind Tariffs

Delving into the justification for these tariffs reveals a flawed equation constructed by the U.S. Trade Representative, which fails to accurately reflect the tariff rates of other nations. The Trump administration asserts that these tariffs are tailored according to trade balances, stating that an excess of imports over exports is tantamount to "cheating." This perspective narrows the discourse to a view that demonizes countries with trade surpluses, ignoring the broader complexities of international economics.

The administration's goal seems clear: reduce a staggering $1.2 trillion trade deficit to zero, a task that could unintentionally strangle the U.S. economy by disregarding the diverse reasons behind trade balances. The exclusion of the service sector—where the U.S. boasts a substantial surplus—further underscores this simplistic approach to a multifaceted issue.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)