Unleash Your Investment Potential: Paul Harris’ Must-Have Picks for April 2025!

2025-04-22

Author: Liam

Get Ready for Market Maneuvers!

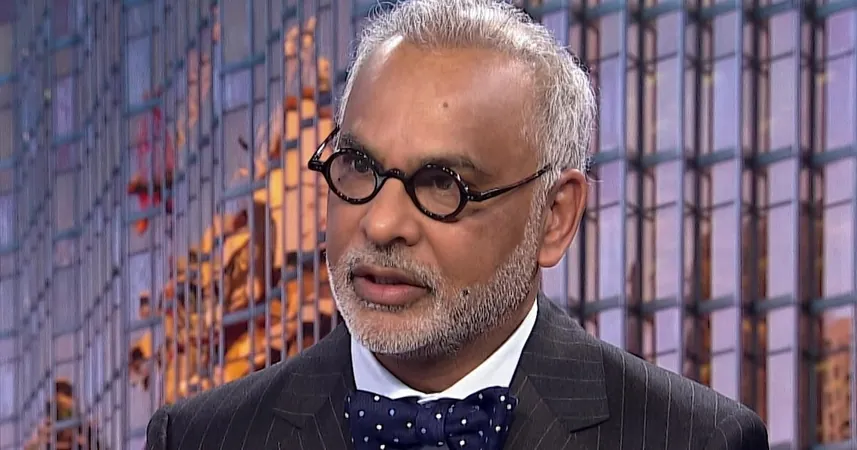

As the financial landscape shifts, portfolio manager Paul Harris from Harris Douglas Asset Management is here to guide you through the opportunities and challenges looming ahead. With a focus on North American and global stocks, Harris reveals his top picks that you shouldn't miss this April!

The Market's Wild Ride: What to Expect

Brace yourself for a surge in market volatility! The uncertainty surrounding U.S. tariffs is casting a shadow over capital markets. What’s more alarming is the unusual behavior of the U.S. dollar and bond prices—these typically move together in crises, but not this time. Foreign investors are hesitating to put their money into U.S. markets, as the Federal Reserve juggles the risks of inflation from tariffs against the potential for slower growth.

But fear not! In every upheaval lies opportunity. Harris encourages investors to see volatility as a friend, allowing savvy buyers to scoop up established firms and new securities.

Paul Harris' Top 3 Picks

Ready to dive into the details? Here are Harris' top three stock picks that are primed for success in this unpredictable environment:

1. MSCI Inc. (MSCI NYSE) - Your Key to Investment Insights

MSCI is not just a provider of data; it’s an essential ally for investors, offering tools for indexing, risk management, and analytics. With staggering gross margins of 82% and operating margins of 53%, it stands as an oligopoly in data analytics, making it a solid addition to any portfolio.

2. Bank of America (BAC NYSE) - America’s Financial Giant

Holding a hefty 10% of all U.S. deposits, Bank of America is a powerhouse restructuring for success with tech advancements and a leaner workforce. With a tier one capital ratio of 13%, the stock currently trades at one times book value. Harris believes its intrinsic value lies at $50, bolstered by deregulation and increased volatility in capital markets.

3. Nvidia (NVDA NASD) - The AI Trailblazer

Leading the charge in AI infrastructure, Nvidia commands attention with its impressive financials: a 75% gross margin, 62% operating margin, and $43 billion in cash reserves! Trading at 21 times earnings, this debt-free leader is set to revolutionize computation and networking solutions.

Past Picks Performance: A Quick Overview

Let’s not forget Harris’ past recommendations. While Stryker faced a slight drop, Essilor Luxottica soared with a remarkable 32% gain! On the other hand, Novo Nordisk struggled with a -52% return. Overall, an average of -6% returns showcases the unpredictability of the market.

Staying alert and informed is key! As we dive deeper into a new quarter, keep an eye on these essential stocks and the whirlwind of market changes.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)