Unmasking Fraud: How Royal Roads University is Leveraging AI to Combat Financial Crimes

2024-10-15

Author: Charlotte

Introduction

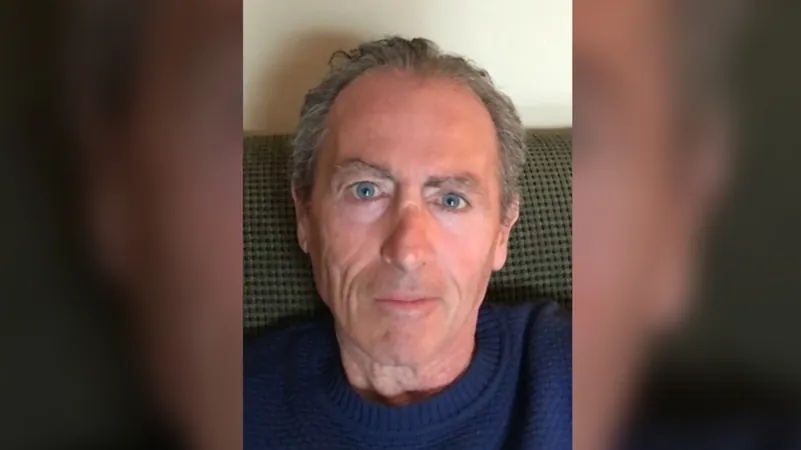

A groundbreaking initiative at Royal Roads University (RRU) is setting the stage for a financial crime-fighting revolution. Professor Mark Lokanan, a data scientist and machine learning veteran, is at the forefront of utilizing artificial intelligence (AI) to sift through enormous amounts of financial data to unveil instances of fraud that may have otherwise gone undetected.

AI Models for Fraud Detection

Lokanan leads a dedicated research team that specializes in creating sophisticated AI models specifically designed for identifying anomalous transactions. By employing advanced pattern recognition techniques, these models aid forensic investigators at banks and other organizations in their scrutinization of suspicious activities. This innovation is vital as the financial landscape becomes increasingly complex.

Custom Algorithms for Financial Misconduct

While AI has already made significant strides in commercial fraud detection, Lokanan's team is focused on developing custom algorithms intended to enhance accuracy for various types of financial misconduct. “Artificial intelligence mimics human intelligence to tackle complex challenges such as reasoning, problem-solving, and making decisions," Lokanan says. His models are tailored to identify deviations from expected patterns in financial statements—an essential feature in a world where financial crime is rampant.

Detecting Atypical Spending Spikes

For instance, his AI can detect atypical spending spikes within corporate financial reports, suggesting the possibility of deceptive practices. When the system notices anomalies, it immediately alerts users, prompting them to investigate further with trained staff.

Advanced Techniques and Testing

A key feature of Lokanan's approach is the use of machine learning and deep learning techniques that rely on robust algorithms tailored through meticulous testing. Lokanan acknowledges, “There’s a significant amount of mathematics involved; the calculations are quite complex." These models are not entirely new, but the way they are applied marks an important advancement in financial fraud analysis.

Validation Against Substantial Datasets

To date, his AI models have been validated against two substantial datasets: one focused on financial statement fraud and another on supply chain fraud. The financial data analyzed came from a comprehensive study conducted by the University of Southern California, encompassing over 1,000 companies scrutinized by U.S. authorities. The supply chain data, readily accessible to the public, addressed issues like manipulated ordering processes.

Spotting Fraudulent Practices

For example, the AI can highlight behaviors such as customers claiming that a product did not arrive after making an order, allowing companies to spot and address potential fraud swiftly. The system is designed not just to flag suspicious transactions but also to generate periodic reports that keep businesses informed about their risk exposure.

Promising Accuracy Rates

While it’s still early days for commercial application, Lokanan reports promising accuracy rates—mid-90s for supply chain fraud and mid-80s for financial fraud detection. With growing interest from academics globally, Lokanan is keen to expand his research's boundaries and applicability.

The Urgent Need for Innovation

The implications are critical: according to the Canadian Anti-Fraud Centre, losses due to fraud skyrocketed from $383 million in 2021 to $530.4 million in 2022, underscoring the urgent need for such pioneering research. Beyond financial fraud, Lokanan is exploring AI applications in other domains, such as employee retention predictions—an essential tool in industries facing high turnover costs.

Future Aspirations and Broader Impact

With aspirations to tackle temporary worker fraud—a significant issue in Canada—Lokanan plans to analyze data from Statistics Canada to help shape best practices and ensure compliance within the workforce.

Conclusion

As Lokanan’s research progresses, the potential for AI not just as a crime-fighting tool but as a transformative element across sectors is becoming increasingly clear. The work being done at Royal Roads University could fundamentally alter the landscape of financial investigations and organizational compliance, and it is a venture that industry leaders should not overlook.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)