What Every Canadian Property Owner in Florida Must Know as Hurricane Milton Approaches

2024-10-08

Author: Amelia

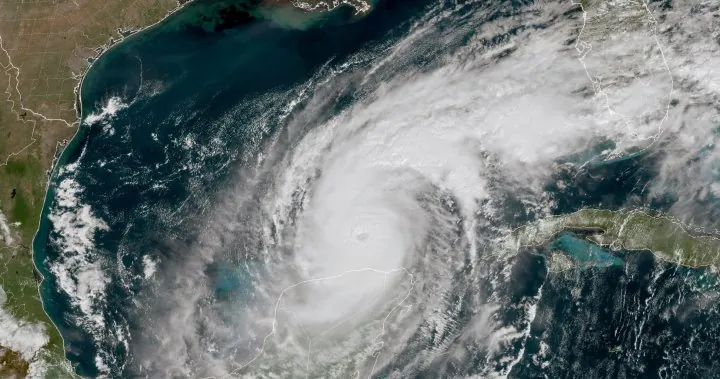

As cold weather descends upon Canada, many citizens flock to the warmth of Florida, but the looming threat of Hurricane Milton—currently a powerful Category 5 storm expected to make landfall as a Category 4—has left property owners north of the border anxious.

According to the National Association of Realtors, Canadians account for a significant portion of foreign property ownership in Florida, representing 13% of buyers. More than half a million Canadians own homes across the Sunshine State, making the potential impact of this natural disaster particularly concerning.

For many Canadians, being outside the U.S. during such an emergency means they may struggle to access aid afterwards. The U.S. Federal Emergency Management Agency (FEMA) states that disaster assistance is primarily restricted to U.S. citizens and qualified non-citizens — leaving many Canadian homeowners vulnerable.

What Can Canadian Snowbirds Do?

So, what can Canadian snowbirds do to safeguard their investments? The Canadian Snowbird Association recommends several pre-storm precautionary steps: trimming damaged trees, securing gutters, retrofitting roofs, windows, and doors to mitigate the risk of storm damage. Keeping all necessary financial and legal documents organized and accessible is crucial, along with taking detailed inventories of personal assets.

Insurance Review

Further protection can be achieved through carefully reviewing insurance policies. Sonia Bolduc, vice-president at NatBank (a subsidiary of Canada's National Bank operating in Florida), notes that mortgage lenders typically require windstorm insurance in addition to standard coverage. However, property owners should also consider flood insurance, particularly if situated in flood-prone zones, as it's not included in regular home insurance policies.

The Importance of Flood Insurance

Mark Friedlander from the Insurance Information Institute emphasizes that flood insurance—typically available through the National Flood Insurance Program—is essential for comprehensive protection. Those policies often cap payouts at $250,000 for damage to the home and $100,000 for personal property, so private insurers may be worth exploring for additional coverage.

Interestingly, only about 20 percent of Florida homeowners currently hold flood insurance, highlighting a widespread unawareness of its necessity. Friedlander advises that starting in 2027, all policyholders with the Citizens Property Insurance Corporation will need to buy separate flood insurance.

Post-Storm Actions

Once Hurricane Milton has passed, swift action is vital. Though Florida law allows property owners up to a year to file claims, timely reporting is crucial for expedient repairs. Canadians, who are typically restricted to six months in the U.S. within a year, may face challenges during this process. Bolduc suggests engaging third-party services or asking trusted neighbors to assess property conditions and document any damage through photos, providing peace of mind.

As you prepare to navigate the aftermath of a hurricane, ensure that you document all property damage thoroughly to streamline your insurance claim. Contact your provider before signing any repair contracts and verify that all hired professionals are licensed and insured.

Understanding Florida's Legal Framework

Finally, it’s essential to remember Florida's legal framework: a moratorium on new insurance policies or modifications kicks in 30 days after a storm watch or warning. Claims for damage cannot be filed if the relevant insurance wasn’t purchased before the storm. Engaging in such actions could be deemed fraudulent, so ensure all paperwork is thorough and accurate.

Amidst the chaos of nature's fury, being informed and prepared is your best defense.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)