10-Year Treasury Yield Surges 1% While Fed Cuts Rates: What’s Behind This Historic Disconnect?

2024-12-28

Author: Lok

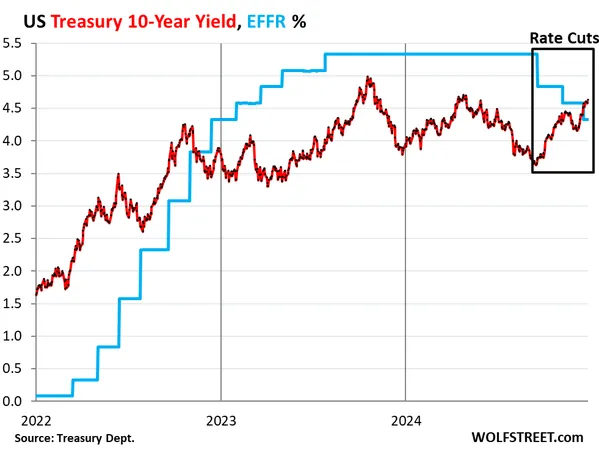

Following an unexpected turn in the financial markets, the U.S. Treasury yield curve has shown signs of steepening, igniting questions about the dynamics between Federal Reserve rate cuts and long-term yield movements. Recent figures unveil a striking contrast: while the Federal Reserve slashed its policy interest rates by 100 basis points, the long-term Treasury yields have climbed by the same percentage, creating what many analysts deem a historic divergence.

Since September 16, just two days before the Fed's rate cut was announced, the 10-year Treasury yield has surged to 4.62%, marking its highest level since May. In tandem, the short-term 5-year and 7-year yields also saw increases of 106 and 105 basis points, respectively. This phenomenon led to discussions about a steepened yield curve, which, after experiencing inversion, has begun to normalize.

To illustrate, the spread between the 2-year yield (4.31%) and the 10-year yield (4.62%) has widened to 31 basis points from a mere 22 basis points just a week prior, indicating that investors are beginning to accept a higher term premium. Normally, when the Fed lowers rates, it's often a response to economic downturns; however, this time around, the economy exhibits robust growth and strong labor market dynamics, leading to astonishment among economists.

So, why the unusual behavior in the markets? One primary factor is the declining inflation rate, with key indicators such as the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index falling significantly since mid-2022. The Fed's monetary policy is often designed to combat rising inflation, and with inflation rates dropping below the current Effective Federal Funds Rate (EFFR) of 4.33%, the reality is that the "real" EFFR is positive for the first time since 2008.

Despite these rate cuts, the economy continues to show resilience, growing at a pace that surpasses the 15-year average, and there are no recessionary signs on the horizon. This divergence between monetary policy and long-term yields reflects nervousness in the bond market, likely tied to renewed inflation concerns. Recent projections from the Fed indicate a potential rise in inflation by the end of 2025 and a reduction in how many rate cuts may occur, casting a shadow over the bond market's optimism.

In exchange markets for mortgages, the effects are palpable as the average 30-year fixed mortgage rate has leaped from 6.11% to 7.11%. This increase has left the real estate sector unsettled, as rising rates pose hurdles for prospective homeowners. Comparatively, mortgage rates above 6% were normal prior to the financial crisis of 2008, leading some experts to hypothesize that we may need to recalibrate our expectations moving forward.

As the financial landscape evolves, the intertwining of Treasury yields, Federal Reserve actions, and economic indicators will undoubtedly be a focal point for investors and analysts alike. The current market conditions raise the stakes, making it essential to remain vigilant about potential implications for both the economy and the wider financial market. The ramifications of these shifts will become clearer in the months to come as investors gauge the long-term impact of rising yields and evolving economic conditions.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)