$100K Bitcoin Options Purchase Sparks Bullish Optimism for New All-Time Highs Post-Trump Inauguration

2025-01-06

Author: Ming

Introduction

As we approach President-elect Donald Trump’s inauguration on January 20, Bitcoin (BTC) is experiencing a considerable uptick in market expectations, with predictions that the cryptocurrency could reach unprecedented heights in the coming months.

Recent Developments

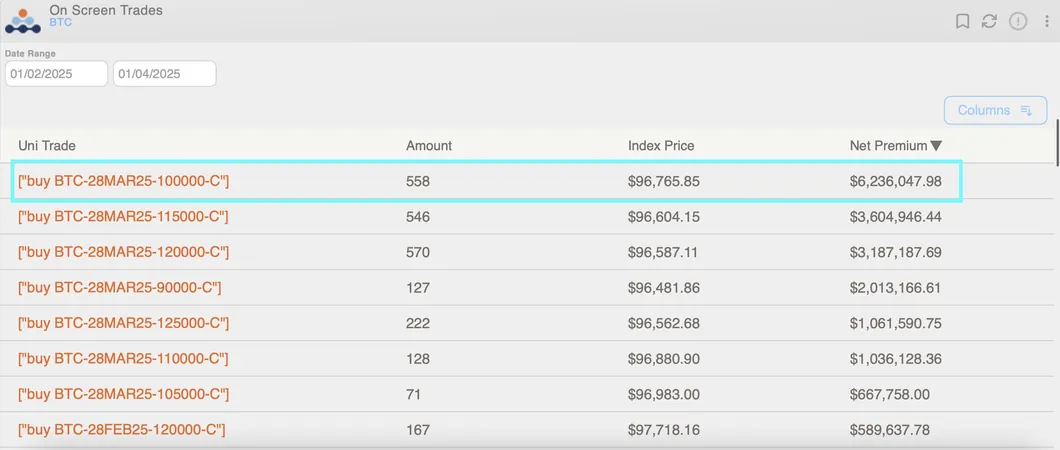

Recent data from Amberdata reveals that a trader on the crypto trading platform Deribit made waves by purchasing call options valued at over $6 million, specifically targeting a $100,000 strike price that is set to expire on March 28. This strategic move signals anticipation among traders that Bitcoin prices will surge to break new records shortly after Trump's official assumption of office.

Market Sentiment

In addition, traders are increasingly optimistic at the $120,000 strike level, which has become the most sought-after option on Deribit, showcasing a staggering notional open interest of $1.52 billion. This surge in call options reflects an overall bullish sentiment as traders position themselves for significant gains from what they believe will be an imminent price rally.

Current Price Trends

As Bitcoin seeks to maintain its momentum above the crucial $100,000 mark—hovering recently above $99,500 after an impressive rebound from December lows of $91,384—the excitement in the market is palpable. Traders and analysts alike are keenly watching for developments that could spur further price growth.

Expert Insights

Greg Magadini, director of derivatives at Amberdata, noted in his weekly newsletter that the period surrounding the inauguration presents an ideal time for "bullish announcements and policies" that may act as catalysts for Bitcoin's ascent. The anticipation for pro-crypto regulatory changes has been a pivotal factor in boosting market sentiment since Trump's election victory in early November, when BTC leapt from approximately $70,000 to peak above $108,000.

Market Volatility

However, the latter half of December has shown signs of volatility, primarily attributed to year-end profit-taking and the Federal Reserve's hawkish monetary projections, which could influence market dynamics moving forward.

Future Outlook

The regulated cryptocurrency index provider CF Benchmarks supports this optimistic outlook, while also cautioning that any delays in the anticipated policy shifts could temper enthusiasm within the market. They assert that a newly restructured SEC under more favorable leadership could alleviate enforcement risks and inspire innovation within the industry, ultimately enhancing investor confidence.

Conclusion

Despite the potential for short-term volatility, the overall sentiment heading into Trump's inauguration remains bullish, with the crypto community eagerly awaiting the opportunities that lie ahead. Will Bitcoin surge to new all-time highs in 2023? Only time will tell, but the signs definitely point to an exciting and potentially profitable future for cryptocurrency investors.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)