Asian Markets Dip as Nvidia's Forecast Clouds Investor Sentiment

2024-11-21

Author: Jia

Asian Markets Dip as Nvidia's Forecast Clouds Investor Sentiment

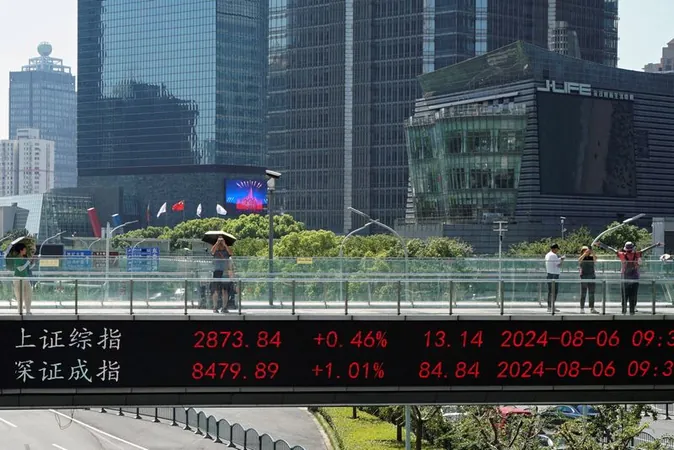

Asian equities experienced a noticeable decline amid concerns sparked by Nvidia Corp.'s tepid revenue forecast and ongoing geopolitical uncertainties. Investors, reacting to a mixed performance on Wall Street, seemed disheartened, pushing most regional stocks down despite Nvidia's otherwise robust earnings report.

Nvidia's Earnings: A Mixed Blessing

Nvidia reported a remarkable surge in sales for the recent quarter, with profits nearly doubling, bolstered by an insatiable demand for its artificial intelligence (AI) chips. The company, now the world’s most valuable, projected revenue of approximately $37.5 billion for its current quarter, exceeding analysts' expectations. This projection highlighted the strong market demand for its next-generation AI chips, the Blackwell series, which are poised to be essential for major tech players like Microsoft, Google, Meta, and Elon Musk's xAI.

Despite these strong numbers, Wall Street reacted negatively to Nvidia's lower-than-expected profit forecasts, causing the company’s shares to drop 2.5% in after-hours trading. Analysts expressed concerns that the anticipated AI boom might be entering a cooling phase, even as companies eagerly race to develop new AI technologies using Nvidia's advanced chips.

Macro Concerns and Regional Impacts

Thursday saw Asian markets retract further, primarily influenced by Nvidia's cautious forecasting which overshadowed their impressive earnings. Japan's technology sector, in particular, felt the impact as stocks declined. Notably, while Nvidia's gains were significant, the prevailing sentiment was that the tech-heavy index may be facing headwinds due to both revenue slowdown forecasts and broader geopolitical tensions affecting market stability.

Focus on Demand vs. Supply Constraints

The challenges Nvidia faces are not due to a lack of interest; rather, the company is grappling with supply chain constraints that are expected to restrict chip availability in the upcoming fiscal periods. Analysts project that demand for Nvidia's chips will continue to outpace supply through fiscal 2026, raising questions about inventory pressures and potential impacts on future revenues.

A Bright Spot Amidst the Gloom

It’s important to note that despite these challenges, Nvidia continues to outshine competitors in the AI hardware market. Their recent quarter showcased an astonishing revenue increase nearly doubling from the previous year, further solidifying Nvidia’s position at the forefront of the AI revolution.

As for Asia, investors are keeping a close eye on both Nvidia's performance and broader economic indicators that may pave the way for recovery or further decline in equity markets. With global tech stocks under pressure and concerns over potential economic slowdown, market analysts urge caution as they monitor the evolving landscape.

Stay tuned for updates as we continue to track how these developments unfold in the fast-paced technology and equity sectors!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)