Bitcoin Rockets Towards $65,000 as Chinese Stocks Defy Expectations!

2024-10-14

Author: Jessica Wong

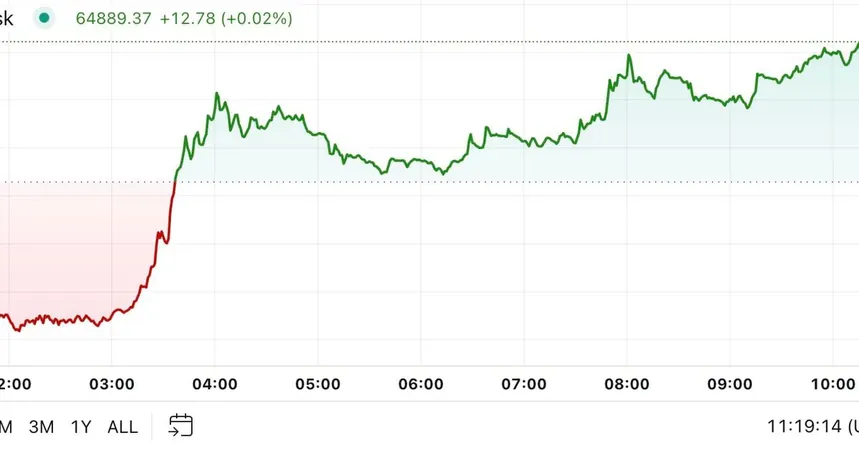

Bitcoin surged, nearing the impressive $65,000 mark, following a surprising rebound in Chinese stocks that managed to shake off lukewarm reactions to recent stimulus plans from the government. Trading at approximately $64,900 during the late morning hours in Europe, the cryptocurrency saw a significant jump of over 3.4% in just 24 hours. The overall digital asset market reflected this bullish sentiment, with the CoinDesk 20 Index climbing roughly 2.9%.

Despite the Chinese government’s latest announcements regarding stimulus measures falling short of analyst expectations, the Shanghai Composite Index defied the odds, closing the day with an increase of more than 2%. “Chinese equities have bounced back after the weekend’s disappointing news, likely keeping risk sentiment in a 'buy everything' mode for the foreseeable future,” shared Augustine Fan, head of insights at SOFA, signaling optimism amidst market fluctuations.

However, investors may want to brace themselves for potential price volatility, as nearly $500 million worth of tokens are set to be unlocked this week. This release includes more than $80 million in Worldcoin's WLD, $51 million in Arbitrum's ARB, and around $40 million each for Eigenlayer's EIGEN and Axie Infinity's AXS. Additionally, Solana's SOL will see $80 million unlocked as part of an ongoing “linear” release strategy, designed to progressively integrate these tokens into the market. This situation creates a dual-edged sword: while the prospect of impending sales could stimulate a preemptive sell-off, there’s also a chance that the market might interpret these unlocks as indicators of progress. If the tokens are associated with staking governance or positive project developments, we could witness price stabilization or even an increase.

In another noteworthy development, Samara Asset Group is making headlines by planning to issue a bond worth up to 30 million euros (approximately $32.78 million) to facilitate further investments in Bitcoin. This strategic move aims to bolster Samara’s already diversified portfolio, which includes expanding stakes in alternative investment funds and enhancing its Bitcoin reserves. Patrik Lowry, CEO of Samara, commented on the bond’s significance, stating, “The proceeds will empower us to solidify our strong balance sheet while diversifying into emerging technologies through new fund investments. With Bitcoin as our primary treasury reserve asset, we are also improving our liquidity position.” Following this announcement, Samara Asset Group's share price witnessed a boost of over 6%, climbing to 2.04 euros on Monday.

With these developments unfolding, the cryptocurrency market remains a hotbed of activity and investors are eagerly watching for signs that could indicate the next big move! Could this be the moment Bitcoin finally breaks through the $65,000 barrier? Stay tuned for more updates!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)