Bond Market Recovers as Investors Seize Opportunity in 4.5% Yields

2024-11-24

Author: Jia

Bond Market Recovery

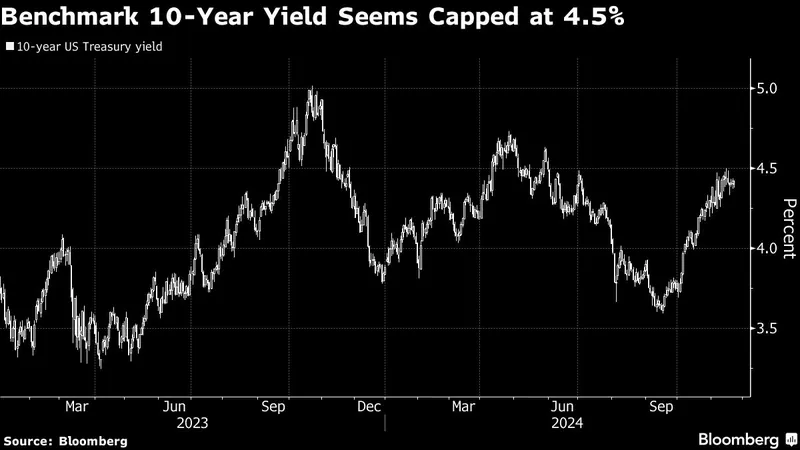

In an unexpected turn of events, the bond market has experienced a significant rebound as savvy investors have rushed in to capitalize on enticing yields of 4.5%. This shift comes after a prolonged period of volatility and declining bond prices, which had left many investors feeling anxious and uncertain about their portfolios.

Buying Opportunity Created by Interest Rate Surge

The recent surge in interest rates had pushed bonds to lower valuations, creating a buying opportunity for those willing to take the risk. Analysts suggest that this could be a pivotal moment, allowing investors to lock in attractive yields that could provide solid returns amidst growing economic uncertainty.

Global Interest in Bonds

As central banks around the globe navigate interest rate policies in response to inflation, the bond market is witnessing renewed interest from both retail and institutional investors. The 4.5% yield represents a significant return, especially in a low-growth environment where other investment options may not perform as well.

Market Outlook and Predictions

Market analysts are now closely watching which direction yields will head next. While some predict continued interest in bonds, others caution that potential rate hikes could once again shake the confidence of buyers.

Strategic Re-evaluation of Bond Portfolios

For those seeking stable income and lower risk, these yields could prove to be a game-changer. Investors are now actively re-evaluating their bond strategies with a focus on adding quality bonds to their portfolios.

Future of the Bond Market

As the bond market stabilizes, it remains to be seen how long this resurgence will last, and whether it is the beginning of a new trend or a temporary blip on the radar of the ongoing financial landscape.

Stay informed and keep an eye on the latest developments in the bond market as opportunities continue to evolve!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)