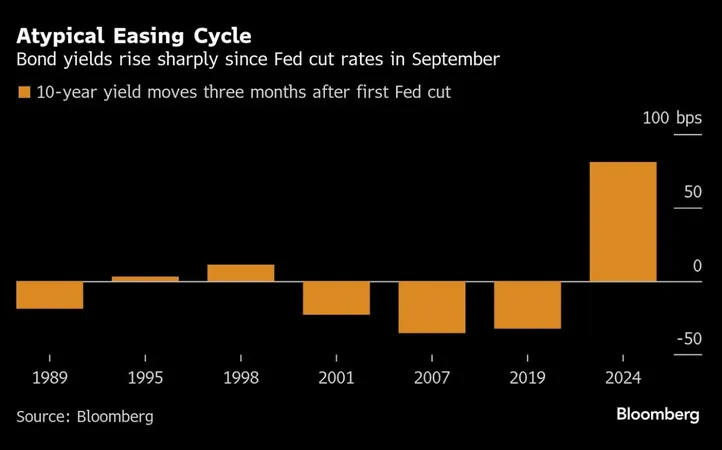

Bond Traders Look to 2025 as Easing Strategy Brings Unprecedented Anxiety

2024-12-22

Author: Lok

Overview

In the ever-evolving landscape of financial markets, bond traders are increasingly setting their sights on 2025 as central banks grapple with an unprecedented period of easing strategies. The decision-making process for these traders has become fraught with tension, reflecting the broader economic uncertainties and a complex interplay of interest rates, inflation, and geopolitical factors.

Easing Measures and Economic Uncertainty

As central banks continue to navigate the choppy waters of post-pandemic recovery, market participants are left wondering how long these easing measures can sustain themselves. Analysts are raising eyebrows as they forecast potential shifts in monetary policy come 2025, predicting that this pivotal year could herald significant adjustments that could affect asset prices across the board.

Bond Trader Anxiety

The angst among bond traders is palpable, as they attempt to gauge the impact of persistent inflationary pressures and labor market fluctuations on interest rates. Many are questioning whether current easing policies, intended to stimulate growth, will ultimately lead to a market correction or even a recession. The stakes couldn’t be higher, with experts warning about the possibility of a "bond bubble" as yields remain subdued amidst expanding debt levels.

Geopolitical Factors

Moreover, geopolitical tensions and supply chain disruptions continue to add layers of complexity to an already fraught economic landscape. With growing concerns surrounding global trade dynamics and the sustainability of recovery, traders are urged to remain vigilant.

Future Outlook and Recommendations

Investors are advised to closely monitor upcoming economic data releases as key indicators will play a crucial role in shaping the Federal Reserve's future decisions. The road to 2025 is not just about prediction; it’s about preparation as traders must navigate this challenging terrain with informed strategies.

Conclusion

As we advance toward this potential turning point, the question remains: will the bond market emerge unscathed, or are we primed for a tumultuous journey ahead? With market volatility at an all-time high, only time will reveal what’s in store for bond traders looking to 2025.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)