Buyers’ Strike Persists: Pending Home Sales See Minor Uptick but Remain Stuck in the Freeze Zone

2024-12-31

Author: Chun

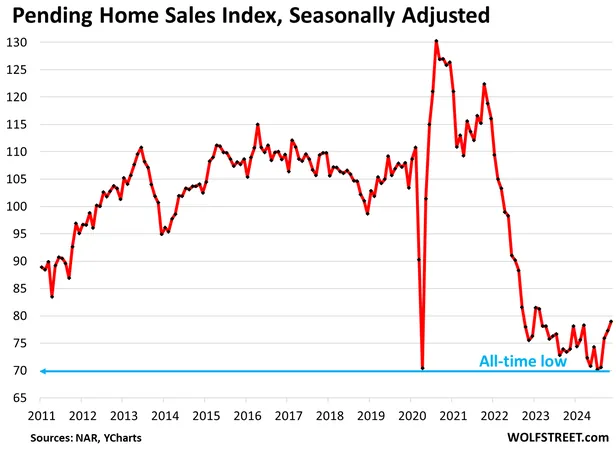

Despite a slight increase, pending home sales are still trapped in a "Buyers' Strike," as prices continue to remain prohibitively high. The National Association of Realtors (NAR) indicates that buyers are beginning to negotiate more effectively as the market shifts away from being primarily dominated by sellers.

November witnessed a notable dip in pending home sales, a key indicator of future completed transactions, which dropped a staggering 20.1% from October. However, thanks to seasonal adjustments, NAR reported a modest month-over-month increase of 2.2%. When compared to November of last year, adjusted figures showed a rise of 6.9%, though this is still a clear indication that the housing market is far from recovery.

Delving deeper into the statistics reveals an unsettling picture: while seasonally adjusted pending sales have improved from record lows, they are still firmly situated in a frozen zone. For perspective, when compared to November figures from previous years, the shifts have been dramatic. The pending sales data reflects the following: - November 2022: +4.6% - November 2021: -33.5% - November 2020: -37.2% - November 2019: -26.9%.

One significant insight from NAR's recent report notes that consumers appear to have adjusted their expectations regarding mortgage rates, capitalizing on the influx of available homes. Despite mortgage rates averaging above 6% for more than two years, buyers no longer seem to wait in anticipation for significant reductions in rates.

As of late December, the average 30-year fixed mortgage rate rose to 6.85%, although it was slightly lower in November, fluctuating between 6.69% to 6.84%. Many analysts now assert that these rates are likely the new normal, following a period of extreme adjustments caused by economic policies in previous years.

Regional trends show a mixed landscape. Seasonally adjusted transactions fell in the Northeast (-1.3%), but climbed in the South (+5.2%), indicating some regional discrepancies in buyer activity. Non-seasonally adjusted data reveals steeper declines across the board, indicating wider market challenges.

A noteworthy trend is the increasing inventory available to buyers. The supply of existing homes for sale has risen to nearly 3.8 months, which stands as one of the highest figures for November in the last eight years, behind only 2018. In addition, new home inventory surged by 57% year-over-year, reaching 124,000 homes. Builders are actively promoting new properties with incentives and price cuts to attract buyers in a competitive market.

Despite the increase in mortgage applications—up 5.6% seasonally adjusted from the previous year—home buying sentiment remains weak. Current mortgage application volumes are still down by 14% compared to 2022 and 45% against 2021 figures.

As we move into December, the ongoing Buyers' Strike leaves many in the market contemplative about their home purchasing decisions, amid concerns of high prices and fluctuating interest rates. The housing market's dynamics suggest potential opportunities for buyers willing to navigate the complexities of today’s financial landscape. Will this movement toward negotiation lead more buyers back to the table, or will the standoff continue in 2024? Only time will tell.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)