Economists Sound Alarm on Hong Kong and Singapore Growth Amid Political Turmoil

2024-12-05

Author: Ting

Overview

In a shocking revelation, a recent Bloomberg survey indicates that the economic prospects for Hong Kong and Singapore in 2024 could face significant headwinds, particularly with the potential return of Donald Trump to the White House and his controversial tariffs, which may exacerbate the already slowing Chinese economy.

Hong Kong's Economic Outlook

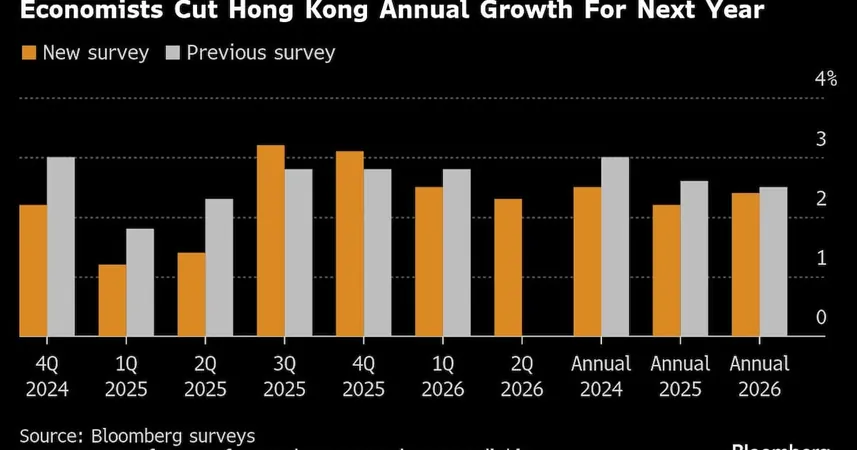

According to the latest reports, economists have slashed their growth forecasts for Hong Kong, expecting a reduction of at least 0.5 percentage points for the upcoming quarters through the first half of 2025. The yearly growth estimate has now been adjusted downwards to 2.2% from the previous 2.6%. Gary Ng, a senior economist at Natixis, highlighted that under these evolving political dynamics, Hong Kong’s economic difficulties will increasingly come to the forefront. "While lower interest rates could provide some relief, the unpredictable trajectory of recovery may hinder consumption and investment gains,” said Ng.

In response to the shifting economic landscape, the Hong Kong government has also adjusted its GDP forecast for this year from a previous range of 2.5%-3.5% to a more conservative 2.5%. At the same time, OCBC Bank's economist, Cindy Keung, anticipates a modest growth of 2.4% for 2024, followed by a further slowdown to 2.2% for the subsequent year.

Singapore's Economic Prospects

Turning to Singapore, the economic outlook appears slightly more optimistic. Economists project that Singapore’s economy might grow by 3.5% in both the first and second quarters of 2024. Nevertheless, expectations for the third quarter have been cut significantly, now estimated at just 1.5%. The final quarter of 2024 is projected to see growth bounce back to 2.5%, pulling the overall annual forecast up slightly to 2.6%, a revision from 2.5%.

Ahmad Mobeen, a senior economist at S&P Global Market Intelligence, cautioned that potential increases in US tariffs could dampen Singapore’s export growth, which is critically linked to the health of global trade. He pointed out that the slowdown in China poses substantial risks to key growth areas for Singapore, such as tourism, merchandise exports, and foreign investments. Mobeen emphasized that while domestic sectors may stabilize, the ripple effects of external factors are undeniable.

Inflation Outlook

Despite these challenges, economists have maintained their inflation outlooks for both headline and core metrics at 2% and 1.8%, respectively, which remain comfortably within the Monetary Authority of Singapore’s forecast range of 1.5%-2.5%.

Conclusion

As global politics continue to influence economic landscapes, the coming year could very well determine the economic trajectories of these two vital Southeast Asian hubs. The question remains: will Hong Kong and Singapore be able to navigate these turbulent waters, or are we witnessing a forewarning of more significant challenges ahead? Stay tuned for updates as this story unfolds!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)