Elon Musk's $56 Billion Pay Package Rejected Again: What It Means for Tesla Shareholders

2024-12-03

Author: Ling

Elon Musk's $56 Billion Pay Package Rejected Again

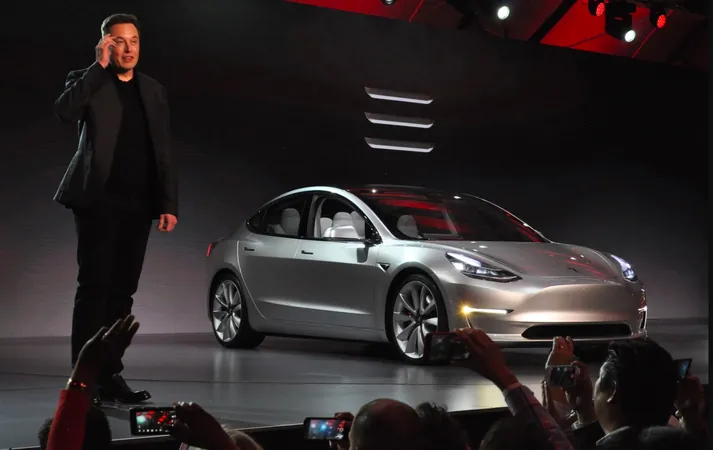

In a dramatic turn of events, a Delaware judge has once again blocked Tesla CEO Elon Musk's staggering $56 billion pay package. Chancellor Kathaleen McCormick, who previously ruled against the compensation deal earlier this year, reaffirmed her decision, declaring that the massive sum was unjustifiable and not in the best interest of shareholders.

The Challenge to Musk's Compensation

The contentious pay package had initially been challenged by Richard J. Tornetta, a relatively minor shareholder in Tesla. He argued that the package, which was tied to specific milestones in Tesla’s growth, represented an 'unfathomable sum' that could be detrimental to the company and its shareholders. Despite a significant vote from Tesla shareholders earlier this summer—all advocating for Musk's compensation—the judge maintained that the interests of one shareholder were significant enough to reconsider the case.

Management's Response

Tesla's management expressed discontent over the ruling, stating, 'A Delaware judge just overruled a supermajority of shareholders who own Tesla and who voted twice to pay Elon Musk what he’s worth.' This statement not only reflects their frustration with the legal outcome but also raises concerns about the power of a single judge to overturn a collective decision made by shareholders.

Legal and Financial Ramifications

Furthermore, the legal battle has resulted in Tesla being ordered to pay a whopping $345 million in fees to the lawyers representing Tornetta and other shareholders—funds that were significantly lower than the more than $5.5 billion that plaintiffs initially sought in the case.

Public Reaction

In terms of public reaction, the ruling has sparked broader discussions in the business world. Republican presidential candidate Vivek Ramaswamy weighed in, labeling the situation a 'threat to capitalism,' underscoring the perception that judicial intervention might undermine stakeholders’ rights.

Judicial Oversight and Shareholder Rights

Chancellor McCormick delivered a pivotal statement regarding the nature of shareholder votes, claiming that allowing defeated parties to find new facts to revise judgments could lead to endless legal disputes. Her concluding remarks assert the judicial system's role in maintaining the integrity of business operations, even against the wishes of the majority.

Looking Ahead

As Tesla prepares to appeal McCormick's ruling, the implications of this saga could extend well beyond Musk’s compensation package. It raises vital questions about the balance between shareholder rights and legal oversight, setting the stage for potential reforms in corporate governance.

Conclusion

Stay tuned, as the outcome of this appeal could reshape the conversation surrounding corporate pay structures and shareholder influence in America.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)