Hershey’s Stock Surges After Rumors of Mondelez Acquisition Talks

2024-12-09

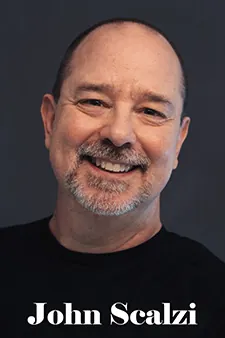

Author: Kai

Hershey’s Stock Surges After Rumors of Mondelez Acquisition Talks

In a surprising turn of events, Mondelez International, the powerhouse behind beloved brands like Oreo and Cadbury, is reportedly in preliminary talks to acquire rival Hershey Company. This potential merger could forge one of the world's largest confectionery giants, reshaping the candy landscape as we know it.

The news ignited a dramatic response in the stock market, with Hershey’s (HSY) shares skyrocketing nearly 15% in midday trading on Monday. According to Bloomberg’s report, Mondelez has reached out to Hershey, though it’s important to note that these discussions may not necessarily culminate in a finalized deal.

Both companies have chosen to remain tight-lipped about the discussions, with Mondelez stating that it doesn’t comment on "market rumors and speculation," a sentiment echoed by Hershey.

The merger would unite two iconic brands that create a plethora of household favorites. Mondelez is not only known for its cookies and chocolate but also owns staples like Chips Ahoy and Ritz Crackers. Hershey, on the other hand, boasts a portfolio that includes the iconic KitKat, Reese’s, Jolly Rancher, and the original Hershey’s chocolate bar.

The current market dynamics are noteworthy, especially with health-conscious consumers dialing back on impulse purchases of sweet treats amid ongoing inflation. Analysts have observed a trend toward major consolidations, with recent high-profile deals like Mars' acquisition of Kellanova for nearly $30 billion casting a long shadow in the industry.

Before the acquisition rumors broke, Hershey’s stock had been struggling, down about 10% for the year. This dip may have positioned Hershey as an attractive target for Mondelez. Randal Kenworthy, a consumer and industrial product expert at West Monroe, highlighted that Hershey’s robust operational capabilities and strong brand portfolio present a compelling case for a potential acquisition. Kenworthy noted that such a union would not only bolster Mondelez’s purchasing power in a competitive cocoa market but also extend its reach into the lucrative North American market, leveraging Hershey's established brand presence while paving the way for expansion into Europe.

As the candy universe braces for what could be a monumental shift, investors and stakeholders will be watching closely to see if these talks lead to a historic merger, reshaping the confectionery landscape and potentially affecting sweet tooths worldwide. Stay tuned for updates on this unfolding story!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)