Hong Kong's Economic Revival: HK$10.5 Billion Boost with a Twist on Property Investment

2025-04-23

Author: Ying

A Promising Economic Surge

Hong Kong's financial landscape is undergoing a remarkable transformation. Just six months after a cautious optimism was expressed regarding the revitalization through the Capital Investment Entrant Scheme (CIES), recent data reveals a staggering HK$10.5 billion (about US$1.35 billion) in approved investments, confirming the initial hopes.

Skyrocketing Applications Point to Growing Confidence

In the early days of the CIES, only 300 applications were received, with a mere three approvals. Fast forward to February 2025: a whopping 918 applications have been logged, 341 of which have been approved, with 756 more given approvals in principle. This isn’t just a trial run—it's a booming program gaining serious momentum!

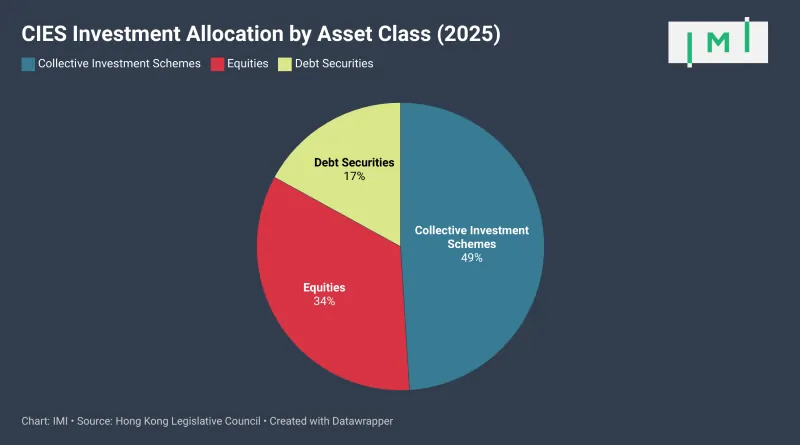

Investment Trends: Financial Markets Thrive, Property Lags Behind

The investment allocations tell an intriguing story. Of the HK$10.5 billion approved, major liquidity flows are favoring financial markets over real estate. The breakdown includes: - HK$5.17 billion (US$663 million) into eligible collective investment schemes, - HK$3.57 billion (US$458 million) into equities, - HK$1.77 billion (US$227 million) into debt securities. Notably, despite new regulations allowing luxury property investments, no applicants have ventured into real estate. This could indicate that the strict HK$10 million (US$1.3 million) cap is too limiting to entice substantial property transactions.

Strategic Policy Shifts Signal Investor Commitment

The Hong Kong SAR Government is taking decisive steps to enhance the CIES. Effective March 1, 2025, new measures include: - A relaxed net asset requirement of HK$30 million (US$3.8 million) over six months instead of two years. - The allowance of Family-owned Investment Holding Vehicles (FIHVs) and Special Purpose Entities (FSPEs), aligning with efforts to position Hong Kong as a hub for family offices. - An expanded option for investing in residential properties priced at HK$50 million (US$6.4 million) or above. These changes aim to broaden access, reduce barriers, and integrate the CIES into Hong Kong's broader asset management strategy.

Family Offices: A New Financial Frontier

While data on family offices created by CIES participants remains scarce, the recent policy adjustments encourage their establishment. This opens avenues for cross-border wealth management and sustainable investment growth, vital for Hong Kong's financial future.

Connecting the Dots: Hong Kong's Unique Geopolitical Position

The updates to the CIES, particularly with FIHVs and FSPEs, reveal Hong Kong's strategic intent to compete with other regional financial hubs. This is not merely about attracting Chinese capital; it emphasizes Hong Kong’s role as a trusted intermediary in global investments, bridging East and West.

Rethinking Real Estate Investment Thresholds?

Despite the overwhelming success of the CIES, some lawmakers advocate for lowering the HK$50 million (US$6.4 million) residential investment threshold to HK$30 million (US$3.8 million). This adjustment could potentially unlock the scheme's real estate component.

CIES: A Pillar for Hong Kong's Economic Resurgence

What started as a whispered hope has transformed into a robust backbone of Hong Kong’s economic recovery. With billions in investments flowing in and a responsive policy landscape, it's clear: the CIES is not just in motion—it’s thriving! Hong Kong is back in business, embracing flexibility and long-term growth, shaking off the slumber of yesteryears.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)