Hong Kong's IPO Market Booms as Companies Rush to List Before 2024 Ends

2024-12-31

Author: Kai

In a promising turn for Hong Kong's capital markets, dozens of companies are gearing up to launch initial public offerings (IPOs) in the city over the next month, marking a notable revival in the IPO landscape. At least six firms have made official announcements indicating their intentions to go public by the end of January, collectively aiming to raise approximately HK$3.3 billion (around $429 million). Notable entries include Bloks Group Ltd., a Chinese toy manufacturer, and Beijing Saimo Technology Co., which specializes in testing autonomous vehicles.

This flurry of IPO activity comes on the heels of recent measures implemented by the Hong Kong Stock Exchange to ease listing requirements for companies already listed on the mainland, alongside encouragement from China's securities regulator for domestic firms to consider Hong Kong as an ideal listing destination. These initiatives form part of a broader strategy to reinforce Hong Kong's status as a leading international financial center.

Investor sentiment is playing a significant role in this sudden surge. Traditionally, IPO announcements tend to rise in June and December, driven by the six-month validity of financial statements. This year, however, there's an added urgency as companies scramble to finalize their listings before the inauguration of Donald Trump on January 20, 2024. Market experts are concerned that potential shifts in U.S. trade policies under Trump's administration could introduce volatility in the markets, particularly affecting Chinese enterprises.

Ronald Chan, chief investment officer at Chartwell Capital Ltd., underscored the strategic timing of these IPOs, stating, “It’s a prudent move to complete offerings before the Trump administration takes office. The uncertainty surrounding his tariff strategies could destabilize the economy and adversely affect valuations.”

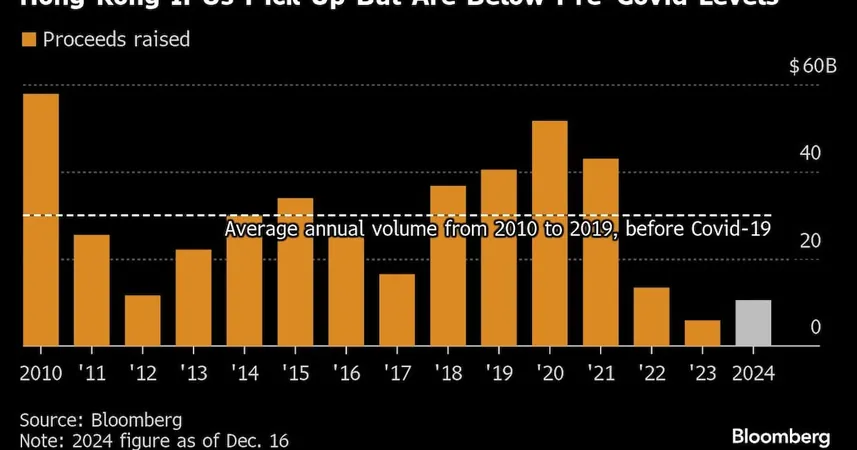

Despite the increase in IPO proceeds — which have nearly doubled to about $10 billion in 2024 — figures remain subdued compared to the yearly average of roughly $30 billion observed prior to the Covid-19 pandemic. The current optimism is reflected in market performance, with the Hang Seng Index rising by nearly 18% this year, buoyed by a wave of stimulus measures from the Chinese government announced in September. Additionally, the Hang Seng China Enterprises Index, an indicator of Chinese stocks listed in Hong Kong, surged by 27%, marking its most robust performance since 2009.

Kenny Wen, head of investment strategy at KGI Asia Ltd., noted that the current market climate favors IPOs: “Sentiment is favorable right now; companies can secure better valuations, and the likelihood of strong stock performance post-listing enhances the motivation to go public.”

As Hong Kong’s IPO market continues to gather momentum, industry experts and investors alike will be watching closely to see if this trend can be sustained, making 2024 a pivotal year for capital raising in the city.

Stay tuned for more updates on the evolving IPO scene in Hong Kong and how these new listings could reshape the financial landscape!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)