How Keeta Conquered Hong Kong’s Food Delivery Market: The Rise of a New Player

2025-04-13

Author: Ken Lee

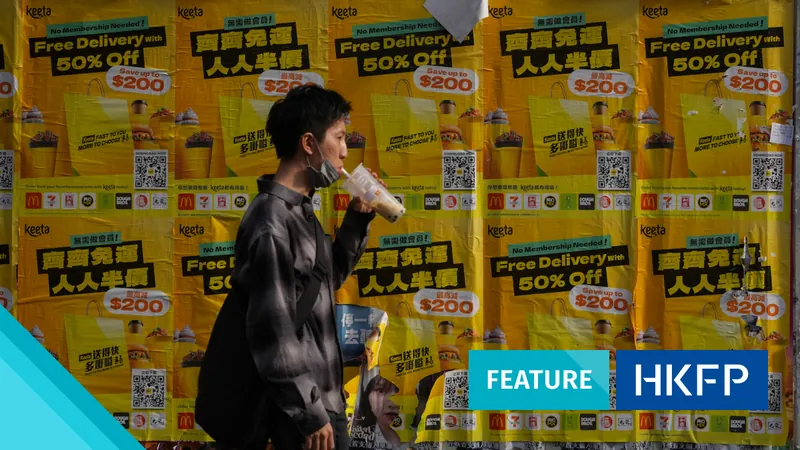

A New Contender Emerges

In a surprising twist for Hong Kong's food delivery scene, Keeta—a delivery platform backed by Meituan, a colossal Chinese retail powerhouse—seized the opportunity just a week after Deliveroo's abrupt exit from the market in March.

Ultimatums and Exclusive Deals

Restaurant owner Chris Chow faced a stark ultimatum from Keeta: raise commission fees from 25% to 28%, or sign an exclusive contract barring him from working with rival foodpanda, the last competitor overshadowed by Deliveroo's departure. This maneuver appeared to be part of Keeta's aggressive strategy to dominate the marketplace.

Market Dynamics Shift

Once Deliveroo withdrew, Chow noted an astounding shift, with over 85% of his takeout orders now coming from Keeta. Despite many claiming loyalty to Deliveroo, reality told a different story — Keeta was thriving.

Cash-Driven Growth

Keeta's rapid ascent in Hong Kong was fueled by a strategy dubbed 'growth before profit.' With deep capital backing, it slashed prices and offered enticing discounts, effectively buying its way into the hearts of consumers. This tactic not only captured customers but also drew delivery workers away from competitors, leaving them in a lurch.

The Competition Takes a Hit

By mid-2024, it became clear that Keeta’s pricing strategy led to Deliveroo’s dramatic decline, with its order share dwindling to just single digits at Chow's second restaurant in Tseung Kwan O. Chow noted, “Deliveroo didn’t stand a chance against Keeta's cash splurge.” Keeta had firmly established itself with a whopping 44% market share by March 2024.

Consumer Behavior and Pricing Wars

While some mourned Deliveroo's exit, Chow highlighted the fact that Hongkongers are practically inclined—they gravitate toward lower prices despite potential political sentiments against Chinese companies. “It’s all about the bottom line,” he observed. Keeta’s aggressive campaigns directly benefitted consumers, although the long-term implications for the industry remain uncertain.

A Double-Edged Sword for Workers

As Keeta expanded, the landscape for delivery workers transformed dramatically. New cohorts were attracted by higher salaries initially, but witnessed pay reductions as the company solidified its market dominance. Chiu, a delivery worker, pointed out that while the initial pay was attractive, Keeta’s tight control over the labor force could lead to exploitative conditions.

Cautious Optimism for Competitors

Competitors like foodpanda are adjusting their strategies, even as concerns grow about the monopolistic tendencies of platforms like Keeta. Many believe foodpanda serves a slightly different audience, one willing to pay more for quality service. In a volatile environment where Chinese corporations are stepping in, experts caution that the local market may suffer under a wave of price wars, which could limit foreign investment in Hong Kong’s food delivery sector.

The Future of Food Delivery in Hong Kong

The ongoing tussle for market share raises questions about the sustainability of Keeta's approach. While it lays down the gauntlet for competitors, it also casts a shadow on the conditions for delivery workers, who may find themselves caught in a cycle of competing for lower pay amidst demands for faster service. Listening to workers’ voices and market dynamics will be crucial as Keeta—and perhaps others—look to claim their share of Hong Kong’s burgeoning food delivery scene.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)