How Stock Connect is Transforming Hong Kong into a Global Financial Hub

2024-11-17

Author: Lok

The Transformative Impact of Stock Connect

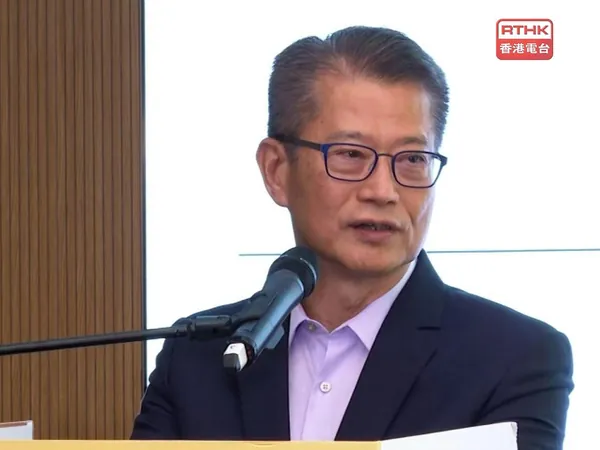

In a bold proclamation this Sunday, Financial Secretary Paul Chan emphasized the transformative impact of the Stock Connect program on Hong Kong's standing in the global financial markets. This cross-border investment initiative, which seamlessly links Shanghai, Shenzhen, and Hong Kong, has significantly heightened the allure of the Special Administrative Region (SAR) for investors worldwide.

Surge in Eligible Stocks

In his latest blog entry, Chan revealed that the roster of eligible stocks has surged to over 3,300, a remarkable increase from around 800 since the program's inception a decade ago. This growth highlights Hong Kong's vital role in bridging mainland China with international investors.

Trading Patterns and Market Turnover

Chan provided insight into trading patterns, noting that mainland investors are now averaging daily transactions of approximately HK$38 billion in local stocks, which constitutes nearly 17% of total market turnover. Meanwhile, overseas investors engaging in buying and selling mainland stocks through Hong Kong are averaging 123 billion renminbi daily, accounting for 6.7% of turnover.

Market Capitalization Growth

The local stock market has also witnessed significant growth, boasting a total market capitalization of HK$35 trillion. This figure marks an impressive 40% increase over the past decade, underscoring the dynamic evolution of Hong Kong as a financial epicenter.

Future Strategies and Goals

Looking ahead, Chan articulated the government's strategy to strengthen ties with the Global South, with the ambitious goal of attracting high-quality companies to list in the vibrant city. Furthermore, there are plans to introduce new cross-border investment products, enhancing Hong Kong's ability to serve as a testing ground for the internationalization of the renminbi.

Global Financial Leaders' Investment Summit

Chan highlighted the upcoming third Global Financial Leaders' Investment Summit, which is set to convene this week, where hundreds of senior officials from international financial institutions will gather. This summit will serve as a crucial platform for participants to gain valuable insights into the mainland's ongoing economic development and the array of financial opportunities it presents.

Conclusion

With such initiatives in place, Hong Kong is not just enhancing its attractiveness; it is positioning itself as a pivotal global financial hub, ready to capitalize on the burgeoning investment landscape. Investors should keep an eye on this rapidly evolving narrative, as the potential for growth seems limitless!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)