Is Bitcoin on the Brink of an 'Apocalyptic' Price Plunge Following White House Revelations?

2025-04-20

Author: Ling

Bitcoin and cryptocurrency markets find themselves in turbulent waters as President Trump’s ongoing trade war sends shockwaves through the financial landscape, raising fears of a potential crisis in confidence regarding the U.S. dollar.

After soaring to nearly $110,000 earlier this year, Bitcoin's value has taken a nosedive amid plunging stock markets, leaving it on the brink of a staggering $19 trillion tipping point.

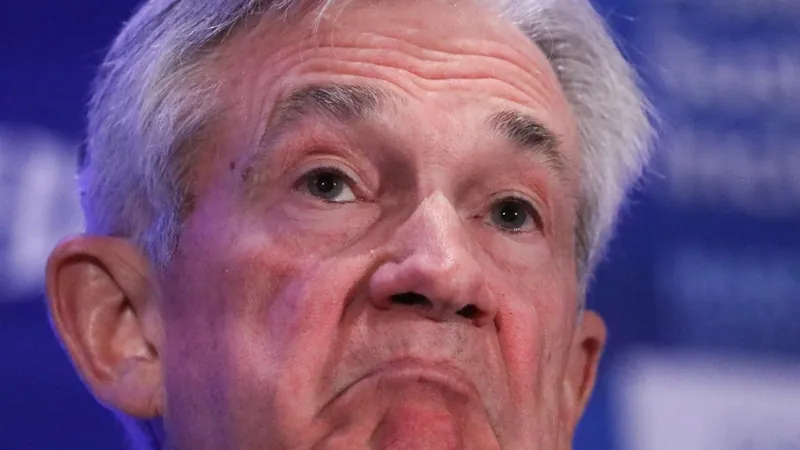

Billionaire investor Ray Dalio has issued a stark warning that the U.S. is on the edge of a financial catastrophe worse than the 2008 meltdown. This grim outlook coincides with reports that Trump is considering whether to dismiss Federal Reserve Chair Jerome Powell, a move that could ignite an 'apocalyptic' scenario for financial markets.

White House economic adviser Kevin Hassett addressed the possibility of firing Powell, stating, “The president and his team will continue to study that matter,” after Trump expressed his urgency for Powell's termination on social media.

Prominent Democratic senator Elizabeth Warren has also raised alarms, suggesting that Trump's willingness to fire Powell could lead to unforeseen ramifications, asserting that 'nobody is safe' in this climate.

Investment analyst Bilal Hafeez elaborated, saying the firing of Powell would represent a monumental shock, describing it as close to an apocalyptic moment for the markets.

Trump's aggressive global trade tariffs have disrupted international trade norms, heightening market unpredictability and pushing investors away from riskier assets like Bitcoin.

While Bitcoin's price appears to be diverging from gold—which has soared to new heights as investors flock to traditional safe havens—some speculate that Bitcoin could emerge as 'digital gold' in the long run.

Investor Lark Davis highlighted Powell's tentative stance, indicating that his reluctance to take decisive action could lead to higher inflation as a result of tariffs. He remarked on the unpredictable nature of the situation, emphasizing that intervention—whether through rate cuts, quantitative easing, or a policy shift from Trump—is inevitable.

As the scenario unfolds, all eyes remain fixed on Bitcoin as it navigates these perilous waters, with many wondering when or if a dramatic resurgence will occur.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)