Is Gavin Newsom's Initiative Enough to Revive Hollywood? Here’s What Needs to Change!

2024-11-26

Author: Jia

Introduction

In the ever-competitive arena of global entertainment, Hollywood—while still a symbol of creativity and imagination—has been facing an alarming decline in production jobs. As the heart of the modern television and film industry, it is increasingly overshadowed by other regions that offer attractive tax incentives and reduced production costs. This situation has persisted for over a decade, prompting calls for urgent action to rejuvenate California's entertainment sector.

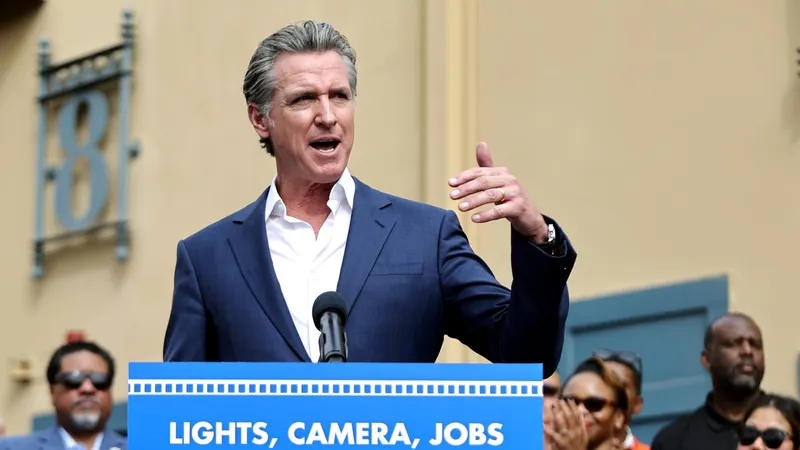

Governor Newsom's Proposal

Recently, Governor Gavin Newsom proposed a plan to double the state's film and television tax incentive program to $750 million annually—a move that could potentially breathe new life into the industry. His proposal is certainly commendable, as it highlights the economic benefits associated with film and television, such as job creation, tax revenue, and increased GDP. However, industry experts believe that this approach is not robust or expansive enough to reclaim California’s status as a premier entertainment hub.

Decline of Unscripted Productions

A startling report from FilmLA shows that unscripted productions in Los Angeles have dropped by an astonishing 56.3% just last quarter. This steep decline raises significant concerns about the economic impact on local industry workers and the broader Californian economy. As unscripted television comprises a significant portion of content produced for both networks and streaming platforms—accounting for nearly half of many broadcasters' slates—it's undeniable that the exclusion of this genre from the tax incentive program is a critical oversight.

Need for Broader Incentives

Unscripted shows are becoming increasingly popular, especially in the rapidly growing connected TV market. Therefore, many industry leaders argue that the Governor's plan should not only focus on scripted productions but also recognize the importance of unscripted formats. By failing to include this category, California risks losing more productions to other states and countries that have embraced these lucrative tax incentives.

Competition from Other States and Countries

States like Georgia, Connecticut, and even international locations such as Canada and Australia have become attractive alternatives for production companies, thanks to their competitive programs. This shift not only affects job creation in California but also highlights the need for urgent reforms in the state's tax credit structure.

Recommendations for Change

To revitalize Hollywood and remain competitive, experts recommend several crucial changes to California's Film and Television Tax Credit Program: - **Include Non-Scripted Productions as an Allocation Category** - **Remove the Cap on Annual Budget for Incentives** - **Raise Credit Percentage for TV production to at least 30% or higher** - **Make Tax Credits Refundable**

Conclusion

Taking these actions could help position California as the ultimate destination for entertainment production, rejuvenating not only Hollywood but also the dreams and aspirations tied to it. For those of us who have dedicated our lives to this industry, Hollywood represents more than just a location—it embodies the stories we long to tell.

Thoughts from Industry Leaders

As Ben Samek, CEO of Banijay Americas, reflects, the world of entertainment is not solely about profit margins; it’s about fostering creativity and telling compelling stories. For California to restore its legendary allure, it must cultivate an economic environment that uplifts—and sustains—one of its most precious industries. The stakes are high, and the time for action is now!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)