Jim Bianco Unveils the "Mar-a-Lago Accord": A Bold Economic Vision for America

2025-03-23

Author: Lok

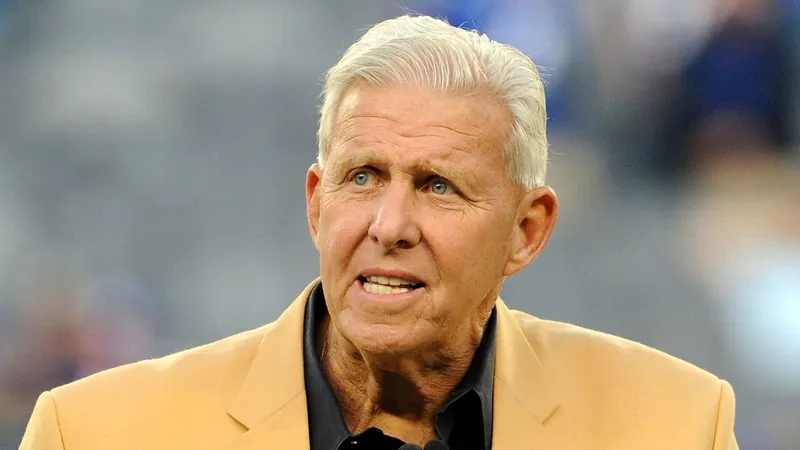

March 21, 2025 – In a captivating interview on Financial Sense Newshour, Jim Bianco of Bianco Research unveiled his insights on what he calls the "Mar-a-Lago Accord," a bold economic strategy put forth by former President Donald Trump during his second term.

This potential framework comes at a crucial moment for the U.S., as the nation grapples with a staggering $36.6 trillion in debt and a 7% GDP deficit demanding immediate action and innovative solutions.

Bianco's plan proposes significant reforms including the introduction of tariffs aimed at rebalancing trade, seeking contributions for military security from allied nations, and the establishment of a sovereign wealth fund—potentially even reevaluating the value of gold. The goal? To boost American manufacturing, lower the overall dollar value, and strive for a targeted 3% GDP growth, acknowledging the short-term sacrifices that may be required for this long-term vision.

The Context of America’s Financial Crisis

The interview highlighted a stark reality: the U.S. is rapidly approaching $37 trillion in debt, with deficits growing by approximately $1 trillion every 100 days. Traditional solutions like taxing the wealthy or implementing minor reforms are no longer viable options. Bianco emphasizes the necessity for innovative thinking to confront what he deems an untenable status quo.

The Mar-a-Lago Accord’s Core Elements

1. **Tariffs and Trade Leverage**: To correct trade imbalances, Trump is expected to utilize tariffs not merely as punishment, but as negotiation tools to regain manufacturing jobs and create a more favorable economic environment within the U.S.

2. **Payment for Security**: A proposal is on the table for European nations to contribute financially to their own defense—a move that acknowledges the U.S. military's historical role in securing trade routes and global stability. This could potentially lead to a decreased financial burden on the American taxpayer.

3. **Sovereign Wealth Fund**: This could be an unprecedented shift, wherein the U.S. government evaluates and monetizes its assets, including real estate and intellectual property, to offset national debt. By increasing asset valuation—like gold which has remained stagnant since 1973—this initiative aims to create a substantial financial buffer.

4. **Economic Goals**: Bianco outlines ambitious aims, projected at a 3% GDP growth, a significant increase in domestic oil production, and measures to bring the deficit down to 3% of GDP through deregulation and currency adjustments.

Challenges and Political Risks Ahead

However, these radical changes are not without risks. The potential for judicial pushback and political resistance from Democrats could impede implementation. Furthermore, Bianco warns that short-term pain might lead to uncertainty in the stock market and economic slowdown, echoing sentiments reminiscent of President Reagan's first term where initial turmoil preceded recovery.

Investment Trends and Shifting Strategies

Bianco predicts that this could also shift the markets toward a new investment model emphasizing thematic investment over traditional index funds. In a world where sectors are being reimagined, there’s a growing sentiment that investors should focus less on broad market indices and more on individual company performance and niche opportunities.

Bianco's forecast suggests a transitional period for American investors—a shift toward finding undervalued assets, exploring new market dynamics, and adapting to what may become a new economic standard.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)