Major Shift Ahead: Digital Wallets Like Apple Pay and Cash App to Face Stricter Bank-like Regulations!

2024-11-21

Author: Wei

Introduction

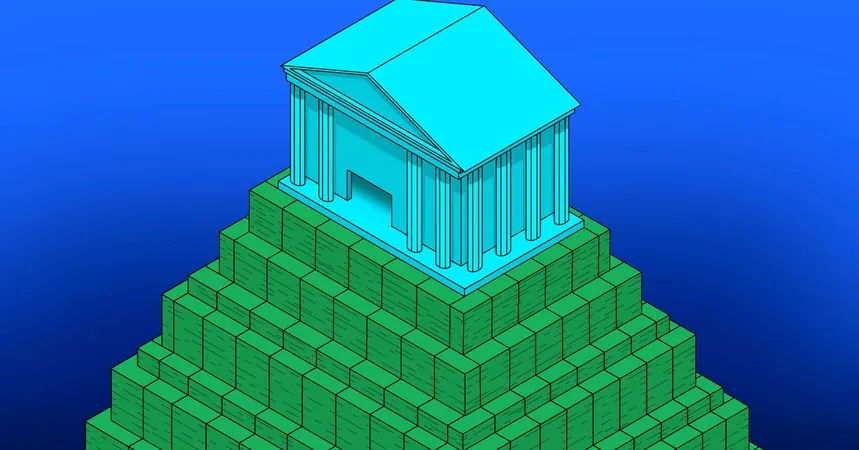

In a groundbreaking move, the US Consumer Financial Protection Bureau (CFPB) has announced that major digital payment platforms are set to be regulated similarly to traditional banks. The new rule, issued on Thursday, targets digital payment apps processing over 50 million transactions annually, encompassing popular services such as Apple Pay, Google Wallet, PayPal, and Cash App.

Regulatory Purpose

This regulatory shift aims to ensure that digital payment providers comply with the same federal laws that govern credit unions and major financial institutions. The CFPB will now have the power to conduct proactive examinations, ensuring adherence to regulations related to consumer privacy, fraud prevention, and more. This initiative follows last year's proposal, which aimed to regulate any company handling over 5 million transactions, indicating a significant tightening of oversight as the digital payments landscape evolves.

The Scale of Digital Payments

The CFPB estimates that the most widely used digital wallets collectively manage over a staggering 13 billion transactions yearly. “Digital payments have transitioned from a mere novelty to an essential part of everyday life, and our regulatory framework must adapt accordingly,” stated CFPB Director Rohit Chopra. “This rule is crucial for safeguarding consumer privacy, combating fraud, and ensuring that account closures are not handled unlawfully.”

Expected Changes

With the new regulations poised to take effect 30 days after their publication in the Federal Register, consumers should brace themselves for changes that may affect how they use digital wallets. This move not only enhances consumer protection but also establishes a more accountable environment for digital transactions, which are increasingly central to our modern economy.

Conclusion

Are you ready for these changes? How will stricter regulations impact your digital payment experience? Stay tuned for more updates!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)