Nike's New CEO Aims to Rekindle Passion for Sports as Shares Plummet Amid Revenue Concerns

2024-12-19

Author: Jessica Wong

Overview of Nike's Current Financial Situation

Nike has recently released its quarterly results, surpassing conservative market estimates initially. However, investor enthusiasm swiftly faded as the company's top executives predicted a troubling decline in revenues by double digits in the upcoming third quarter.

CEO's Commitment to Rejuvenate the Brand

In a revealing statement during his first earnings call since taking over in October, Nike's new CEO Elliott Hill expressed concern that the company had "lost its obsession with sport." He pledged to rejuvenate the iconic brand by refocusing on its sports roots and increasing the sales of premium-priced products, hinting at a strategic shift back to the brand's core values.

Quarterly Performance and Revenue Insights

Despite reporting a quarterly profit that exceeded expectations, Nike’s revenue fell less than forecasted, buoyed by the success of new performance and running shoes that have begun to attract shoppers’ interest again. Nevertheless, so far this year, Nike's shares have dropped nearly 30%, leaving analysts skeptical about Hill's ability to counteract these disappointing trends given the fierce competition in the athletic wear industry.

Strategic Shifts Proposed by CEO Hill

During the earnings call, Hill emphasized the need to strengthen Nike's retail partnerships, enhance innovation, and limit the frequency of discounts and promotions that have largely characterized recent sales strategies. "We’ve become far too promotional," Hill stated with evident passion, pointing out how excessive markdowns not only hurt Nike's image but also affect the profits of retail partners.

Product Launches and Market Competition

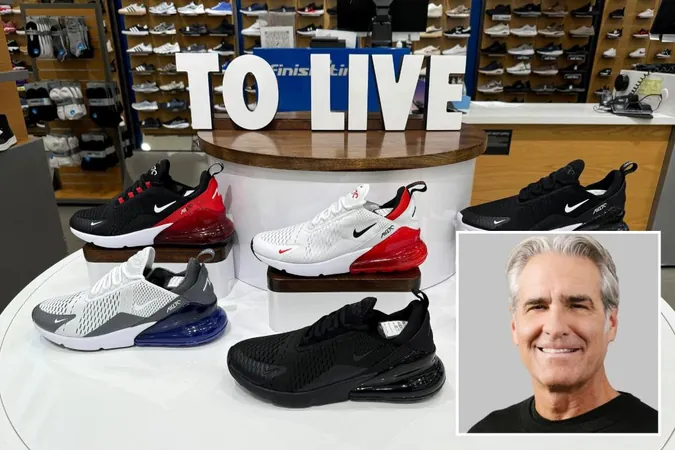

As competitors continue to launch more comfortable and well-cushioned footwear, Nike is racing to regain its market dominance. The company is investing in new product launches, including popular lines like the Air Max 95 and the iconic Jordans and Pegasus.

Focus on Key Running Shoe Lines

Last month, under Hill's direction, Nike announced plans to focus on three key running shoe lines—Pegasus, Structure, and Vomero—by introducing multiple iterations at varied price points to cater to a broader consumer base.

Retailer Perspective and Collaboration

Hill has garnered support from retailers, who are optimistic that he will revitalize the previously strong third-party partnerships that Nike had distanced itself from in 2020, shifting toward a direct-to-consumer model. This pivot left some retailers scrambling, while others like Foot Locker maintained a substantial dependency on Nike products, purchasing 65% of their sports apparel from the brand.

Sales Performance of Foot Locker

However, Foot Locker recently reported lackluster sales, attributing their downfall to weak demand for Nike shoes but also expressed eagerness to collaborate with Hill in the future.

Second Quarter Financial Results

In its second quarter, Nike's net revenue dipped 7.7%, reaching $12.35 billion, which was better than initial analyst predictions of a 9.41% drop to $12.13 billion. The company reported earnings per share of 78 cents, outperforming the projected 63 cents by analysts.

Analyst Perspectives on Future Outlook

While analysts like Jessica Ramirez from Jane Hali & Associates acknowledge the numbers are "not good," she also pointed out that the results were "better than most people feared." As Nike navigates this challenging landscape, all eyes will be on CEO Elliott Hill's strategies to revive the brand's connection to sports and ultimately boost its market performance. Will Nike reclaim its title as the leading sneaker brand, or will competitors steal the show? Stay tuned!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)