Nio Falls Short in Q3 Revenue, but Gross Margin Shows Improvement: What This Means for Investors!

2024-11-20

Author: Kai

Nio Reports Mixed Q3 Financial Results

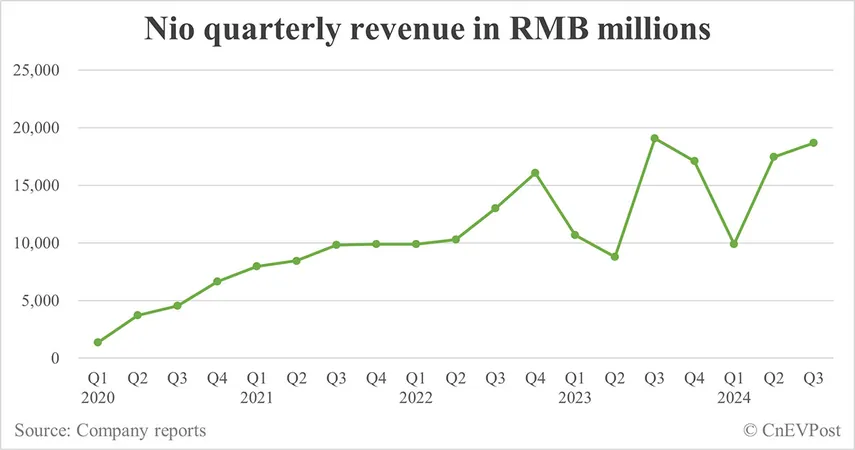

In a surprising turn of events, Nio, the prominent Chinese electric vehicle (EV) manufacturer, has reported third-quarter revenue that failed to meet expectations, yet managed to showcase an improvement in its gross margin. This mixed bag of financial results presents a complex picture for shareholders and potential investors as the company navigates its growth trajectory.

Q3 Financial Performance

For the third quarter of 2024, Nio announced a revenue of RMB 18.67 billion (approximately $2.66 billion). While this figure is a slight decline of 2.1% year-on-year, it marks an encouraging 7.0% increase from the previous quarter, showcasing resilience in the face of challenges. However, the reported revenue fell short of analysts' projections, which placed it at around RMB 19.17 billion, and also dipped below the company's own guidance range of RMB 19.11 billion to RMB 19.67 billion.

Despite the revenue hiccup, Nio achieved a significant milestone by delivering a record 61,855 vehicles in Q3, marking an impressive year-on-year growth of 11.59% and a sequential rise of 7.81% from Q2. The company has set ambitious guidance for the fourth quarter, forecasting vehicle deliveries between 72,000 and 75,000 units, which could represent a staggering year-on-year growth of 43.9% to 49.9%.

Gross Margin Improvement

Nio’s gross margin has seen a noteworthy improvement, climbing to 10.7%—its highest since Q3 2022—up from 8.0% in the same quarter last year. This increase is attributed to enhanced vehicle margins and a robust sales growth in high-margin parts and services. Nio’s vehicle margin also rose to 13.1%, signaling ongoing cost optimization strategies that appear to be yielding results.

Challenges and Future Outlook

The company faced a net loss of RMB 5.06 billion in Q3, an 11.0% increase from last year. Notably, the adjusted non-GAAP net loss was reported at RMB 4.41 billion, highlighting the ongoing challenges without the overhead of equity incentives. The rise in losses, however, did come alongside an increase in research and development spending, which reached RMB 3.32 billion, demonstrating Nio’s commitment to innovation.

As of September 30, 2024, Nio boasts a robust cash position, with RMB 42.2 billion in cash and equivalents available to fuel future growth initiatives. This financial cushion is crucial as the company gears up for a new product launch cycle anticipated to start next year, which executives believe will propel sales volumes and enhance overall company performance.

Investor Sentiment

Investors and industry analysts are closely watching Nio's next moves, especially as it aims to leverage its expanded vehicle range and technological advancements in the highly competitive EV market. Could Nio’s commitment to growth and innovation turn around its fortunes in 2025? The coming months will be pivotal for this ambitious automaker as they seek to reclaim market expectations.

Conclusion

Stay tuned for the next chapter in Nio's electrifying journey!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)