Nvidia Stock Soars Ahead of Earnings as Analysts Set Their Sights High

2024-11-19

Author: Yan

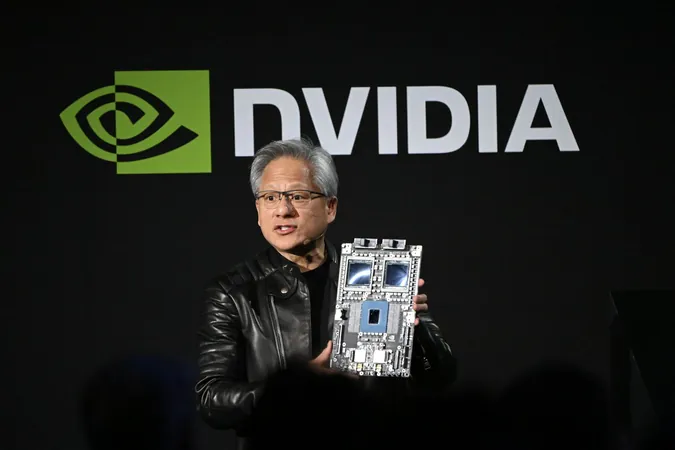

Nvidia's shares surged on Tuesday, just one day before the company's much-awaited third-quarter earnings report. This rise comes as analysts express growing optimism about the semiconductor giant's future prospects.

Recent projections for Nvidia's quarterly performance have seen an upward trend, with estimates indicating that revenue is set to skyrocket by 84% year-over-year, reaching an impressive $33.29 billion. This remarkable growth is largely attributed to record-breaking sales from Nvidia's data center segment, which has become a critical source of revenue for the company.

In a Monday report, analysts at Stifel reinforced their bullish outlook by issuing a “buy” rating for Nvidia's stock, increasing their price target from $165 to $180. This adjustment suggests a potential upside of around 23% from the stock's intraday price on Tuesday. Analysts noted that Nvidia is positioned to tap into a massive total addressable market projected to exceed $100 billion by the end of 2025, with long-term opportunities potentially approaching a staggering $1 trillion.

The Stifel analysts highlighted that the most significant growth in the near to medium term is expected to stem from sectors like high-performance computing, hyperscale and cloud data centers, as well as enterprise and edge computing. They emphasized that demand for AI computing resources continues to significantly outpace supply, a trend that is likely to fuel Nvidia's growth even further.

As companies across various industries increasingly integrate AI capabilities, Nvidia’s advanced GPU technology places it at the forefront of this evolving landscape. With AI development becoming a priority for numerous organizations, Nvidia's upcoming earnings report could set the tone for the future of tech stocks, raising the stakes for investors eager to capitalize on the potential of AI-driven markets.

Stay tuned as the earnings report reveals whether Nvidia can meet these high expectations and continue its impressive trajectory in the semiconductor space.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)