Nvidia Stocks Soar for Fifth Consecutive Day as Wall Street Bets Big on AI's Future!

2024-10-08

Author: Wai

Nvidia Stocks Soar for Fifth Consecutive Day

In a remarkable display of market confidence, Nvidia (NVDA) saw its stock price climb 4% on Tuesday, marking its fifth consecutive day of gains. This surge is fueled by a collaborative bullish outlook from leading Wall Street analysts, including KeyBanc, Citi, and Bernstein, who have reaffirmed their “Buy” ratings on the tech giant.

Analysts Elevate Sales Forecasts

KeyBanc analysts have notably elevated their sales forecast for Nvidia's fiscal year 2025 from $128.5 billion to an impressive $130.6 billion. This optimistic revision is significantly bolstered by the anticipated contribution of Nvidia’s flagship Blackwell AI chips, projected to add a remarkable $7 billion to the company’s revenues in Q4. In stark contrast, Wall Street's consensus estimate sits at $125.6 billion for 2025 revenue, highlighting just how confident analysts are in Nvidia's trajectory.

Robust Demand for Previous Chip Models

Demand for Nvidia's previous chip models, including the H100s and H200s, remains robust, even as the company ramps up production of the latest Blackwell chips. “The demand is sky-high,” KeyBanc noted in a report, reflecting the broader trend of increasing reliance on AI technologies across various industries.

Potential Influx of Funding for AI Startups

The excitement surrounding Nvidia is further amplified by reports from Wedbush analysts, who perceive a potential influx of funding for AI startups. Following OpenAI's astonishing $6.6 billion funding round, the tech sector is poised for a new wave of investment that is expected to boost demand for Nvidia's advanced AI chips. Matt Bryson from Wedbush stated, “This suggests there's little chance of AI spending growth halting anytime soon, which bodes well for Nvidia.”

Nvidia's Ambitious AI Software Goals

Nvidia isn't just positioning itself as a chip maker; the company is actively promoting its AI software capabilities during its AI Summit in Washington, D.C., signaling its ambition to be recognized for more than just hardware.

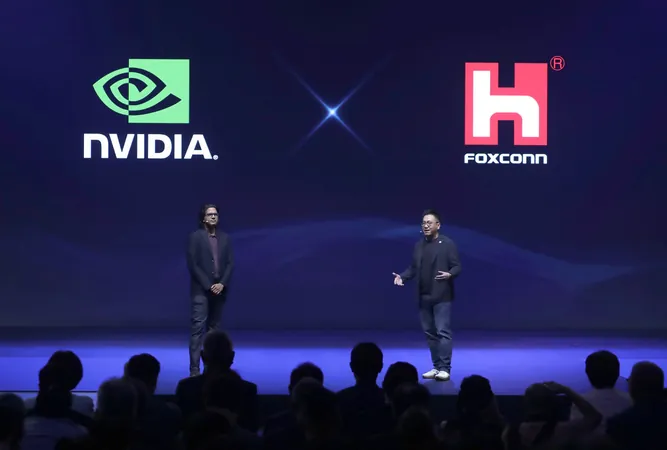

Foxconn's New Factory and Collaboration

Adding to the excitement, Foxconn announced the construction of the world's largest factory to assemble Nvidia's AI servers right in Mexico. Young Liu, chair of the Taiwanese electronics giant, emphasized the "crazy" demand for Nvidia's latest AI chips, which will help reduce Nvidia's dependence on Chinese manufacturing in light of escalating trade tensions. Both Nvidia and Foxconn are also collaborating to create Taiwan's fastest supercomputer.

Promising Growth for the Semiconductor Sector

While Nvidia thrives, the semiconductor sector as a whole is showing promising growth. According to data from the World Semiconductor Trade Statistics (WSTS), semiconductor sales skyrocketed by 28% in August compared to the previous year, prompting JPMorgan analysts to express continued optimism for the sector's future, anticipating further increases in both stocks and earnings power through 2024 and 2025.

Challenges for Chinese Chipmakers

In stark contrast, Chinese chipmakers faced obstacles as China's economic planning agency failed to deliver on expected stimulus measures, leading Semiconductor Manufacturing International Corporation (SMIC) shares to drop by 18%. Investors had hoped that such initiatives would revitalize China's semiconductor industry.

Conclusion: Nvidia's Growing Role in AI Technology

This ongoing divergence between Nvidia's soaring success and struggles in other regions exemplifies the intense competition and rapidly changing dynamics of the tech and semiconductor landscapes. As AI technology continues to evolve, Nvidia's role as a key player will likely expand, making it a stock to watch closely in the upcoming months!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)