Nvidia's Earnings Report: Will the AI Giant Maintain Its Momentum?

2024-11-20

Author: Kai

Nvidia's Upcoming Earnings Report

Nvidia is set to announce its highly anticipated third-quarter earnings this Wednesday, right after the market closes. Investors and analysts alike are keenly watching for insights into Nvidia's demand outlook for the remainder of the year and beyond.

Nvidia's Dominance in the AI Market

Nvidia (NVDA) has established itself as a titan in the technology sector, boasting a staggering 90% share of the market for artificial intelligence accelerators. These essential chips and processors fuel the expansive data systems utilized by major hyperscalers like Microsoft (MSFT) and Amazon (AMZN). Just this year, Nvidia has added over $2.2 trillion to its market value, an extraordinary feat that underscores its dominance in the AI and computing space.

Sales Growth and Future Projections

Over the last five quarters, Nvidia has consistently doubled its sales. Projections indicate that the company is on track to achieve around $126.4 billion in fiscal 2025 revenue. However, challenges loom on the horizon, especially concerns over supply constraints and budding competition from rivals like Advanced Micro Devices (AMD).

Profit Surge Despite Challenges

Despite these hurdles, Nvidia is poised to report another extraordinary profit surge. Analysts predict the company's profits for the quarter ending in October could reach approximately $17.4 billion, reflecting continued growth in overall revenues. However, this stellar performance may lead to more conservative forecasts for the fiscal fourth quarter, prompting investors to reconsider their short-term expectations for the world's most valuable stock.

Key Analyst Insights

Logan Purk, a technology analyst at Edward Jones, emphasized, "Investor focus remains on Nvidia's ability to continuously increase guidance well ahead of expectations. These projections serve as key indicators for the potential demand for AI technologies."

Forecasted Revenue Figures

In the upcoming earnings report, Nvidia is expected to release revenue figures about 83% higher than the same quarter last year, amounting to $31.16 billion. However, the growth rate is projected to slow to around 66% for the three months ending in January, indicating the need for careful analysis moving forward.

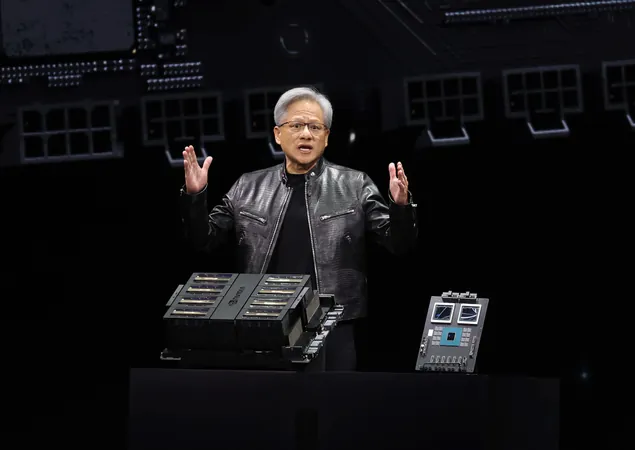

Performance of Blackwell Processors

A critical aspect of the report will be the performance of Nvidia's newly launched Blackwell processors, which have been under scrutiny due to initial design flaws and supply-chain challenges. Chief Financial Officer Colette Kress previously assured investors of "several billion" in sales from Blackwell, and Wall Street forecasts for its fourth-quarter revenue range between $5 billion and $8 billion.

Market Sentiment and Future Outlook

Stephanie Link, Chief Investment Officer at Hightower, noted, "Nvidia heads into earnings with heightened expectations. The stock has soared 172% year-to-date and gained 5% just in the past month. While there's a strong anticipation for a potential earnings 'beat,' investors must remain cautious about a possible revenue slowdown as we await the next-generation Blackwell products."

Conclusion and What Lies Ahead

As Nvidia prepares to unleash its earnings report, the tech giant's long-term growth prospects amidst heightened valuations have become a focal point. Will Nvidia continue to pave the way in the AI landscape, or will emerging challenges dampen investor enthusiasm? Stay tuned!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)