Nvidia's Stock Takes a Hit as China Launches Antitrust Investigation: What You Need to Know!

2024-12-09

Author: Chun

Overview

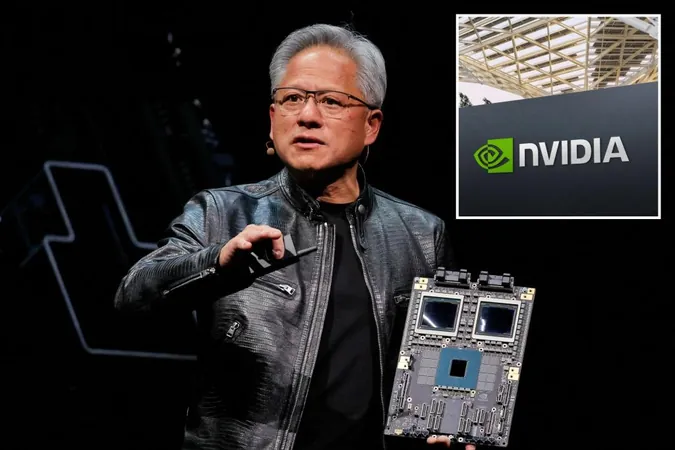

Shares of Nvidia, the industry-leading microchip company, tumbled on Monday after Chinese regulators announced an investigation into potential violations of the country's anti-monopoly laws. This development raises serious concerns for one of the most valuable companies in the tech sector.

Details of the Investigation

The probe is reportedly centered around Nvidia's $6.9 billion acquisition of Mellanox, a network and data transmission company, which took place in 2019. With Nvidia’s stock dropping by 2.6% to $138.81, it remains to be seen how the market will react in the long term. Despite this dip, Nvidia's stock is still up an astonishing 180% so far this year, fueled by skyrocketing demands for artificial intelligence (AI) technologies.

Nvidia's Role in AI

Nvidia has become a cornerstone of the AI industry, driving innovation and revenue growth as tech giants invest heavily in its advanced chips and data centers necessary for AI development. In their latest earnings report, Nvidia boasted a staggering revenue of $35.08 billion—up 94% from $18.12 billion a year ago—and a profit of $19.31 billion, more than double from the same quarter last year. Notably, approximately 16% of Nvidia's revenue is generated from China, making it a critical market for the company.

Company Response

In response to the investigation, a spokesperson from Nvidia expressed the company's willingness to cooperate with regulators, indicating they are "happy to answer any questions" regarding their business operations. However, the potential ramifications of this scrutiny could force Nvidia to rethink its strategies in the Chinese market, especially with the ongoing geopolitical tensions between the U.S. and China.

Implications for U.S.-China Relations

Experts suggest that this investigation could also be a message from China to the incoming Trump administration, reflecting the complexities of U.S.-China relations. David Bieri, an international finance expert at Virginia Tech, indicated that the reality of working with China comes with political risks, which Nvidia will have to navigate carefully moving forward.

Conclusion

Furthermore, Nvidia's recent ascendance as the most valuable company—surpassing giants like Microsoft and briefly Apple—shows just how critical the chip sector has become for tech companies worldwide. Unlike its rival Intel, Nvidia designs its own chips but outsources manufacturing primarily to Taiwan Semiconductor Manufacturing Company (TSMC). The stakes are high as the outcome of this investigation could not only affect Nvidia’s business strategy but also set the tone for how U.S. companies interact with China in the future. Will Nvidia be able to weather this storm and maintain its position as a leader in the AI marketplace? Only time will tell. Stay tuned for further updates on this developing story!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)