Panic Grips Brazilian Traders: ‘Sell First, Ask Later’ Becomes the Norm!

2024-12-18

Author: Ken Lee

Overview

In a startling turn of events, Brazilian traders are now adopting a 'sell first, ask later' mentality as panic sweeps through the financial markets. This brutal shift can be attributed to a confluence of factors, including rising inflation rates, political instability, and global economic uncertainties.

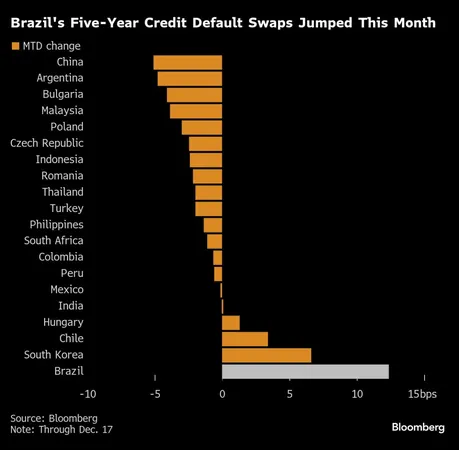

Market Reactions

Market analysts report that the recent fluctuations in Brazil’s stock exchange have led investors to react impulsively, often offloading stocks without thorough evaluation. The immediate fear centers around the potential for further economic deterioration, pushing traders to safeguard their capital by liquidating assets.

Currency Impacts

In the wake of this chaos, the Brazilian Real has weakened significantly against major currencies, raising concerns about inflation and consumer purchasing power. The central bank is reportedly monitoring the situation closely, with whispers of potential monetary interventions to stabilize the currency.

Political Uncertainty

Compounding the issue are looming elections that have led to increased uncertainty regarding economic policies. Traders are wary of potential disruptions, leading to knee-jerk reactions in the market. Economic experts warn that this could lead to a vicious cycle of panic selling, further destabilizing the market.

Future Outlook

As more traders join the exodus, the question remains: how long can this 'sell first, ask later' mentality persist before it leads to a deeper market crisis? Investors are advised to remain cautious as the situation develops, and stakeholders are urged to implement strategic measures to mitigate risks.

Conclusion

Stay tuned as we continue to bring you the latest updates on Brazil’s shaky market. Will traders regain their composure, or is this just the tip of the iceberg? Only time will tell!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)