Qiniu Sets Its Sights on IPO Amid Hong Kong Stock Surge

2024-10-04

Author: Chun

Qiniu Sets Its Sights on IPO Amid Hong Kong Stock Surge

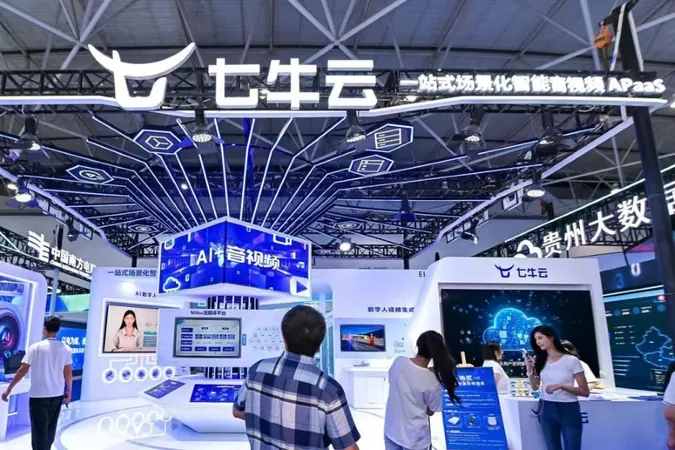

In a bold move that aligns with the recent surge in Chinese stocks, Qiniu Ltd., China's third-largest audiovisual platform as a service (PaaS) provider, is making a comeback to the Hong Kong Stock Market. Despite reporting significant losses over the past years, Qiniu is attempting to capitalize on the renewed positive sentiment in Hong Kong's trading environment.

Key Highlights:

- Qiniu reported losses exceeding 750 million yuan in the last three years, with the deficit escalating 50.5% year-over-year in Q1 2024 to hit 143 million yuan.

- The cloud services provider counts high-profile investors such as Alibaba, Qiming Venture Partners, and MPCi among its supporters.

After a three-year slump, Hong Kong's stock market has recently witnessed a revival, with the Hang Seng Index climbing over 30% as investors become hopeful for a robust recovery of the Chinese economy. The rally gathered momentum following Beijing's announcement of a fresh set of stimulus measures on September 24, triggering unprecedented trading activity. The Hong Kong Stock Exchange recorded a staggering turnover of HK$445.7 billion ($57.3 billion) on September 27, following a week where the benchmark Index soared more than 2,373 points.

Amid this favorable climate, Qiniu, who finally got past its listing hearing on September 22, is looking to seize the moment. After two previous unsuccessful attempts to get listed in Hong Kong, they are aiming to raise approximately HK$457 million from their IPO with shares expected to debut on October 16.

Founded in 2011, Qiniu’s PaaS platform provides a suite of audiovisual services to users via cloud-based infrastructure. The company offers two core products: MPaaS (Multimedia Platform as a Service), which enables access to audiovisual content, and APaaS (Application Platform as a Service), aimed at helping users design and manage their applications effectively. Notably, revenue from its APaaS segment is on an accelerated growth trajectory, rising from just 1.7% of total revenue in 2021 to 24.3% by the end of March this year.

While Qiniu's 2022 revenue rose to 1.33 billion yuan ($189 million), its financial health has taken a hit with reported losses climbing gradually from 220 million yuan in 2021 to a staggering 324 million yuan last year. The company's ongoing losses can primarily be attributed to rising operational costs and fair value losses on convertible securities. Qiniu is focused on transforming these losses by optimizing its business processes and expanding its APaaS offerings.

Industry veteran Xu Shiwei, the company's founder, has played a crucial role in securing investment from influential stakeholders, having raised over 3 billion yuan since inception. With Qiniu's valuation estimated at $721 million post-IPO, the upcoming listing could provide an exit strategy for early investors while injecting fresh capital into the company.

Interestingly, the broader cloud services market in Hong Kong has been under pressure, with stocks like Ming Yuan Cloud and Bairong witnessing declines of around 20% and 10% respectively. Nonetheless, Qiniu’s higher price-to-sales ratio compared to its peers indicates an underlying confidence among investors, especially in the wake of recent market shifts. Can Qiniu successfully navigate its upcoming IPO and leverage this momentum? Only time will tell, but it certainly stands to gain if it capitalizes on the current bullish market sentiment.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)