Qualcomm’s Hold Over Apple: Could Their 5G Modem Partnership End Badly for the Tech Giant?

2024-12-08

Author: Chun

Introduction

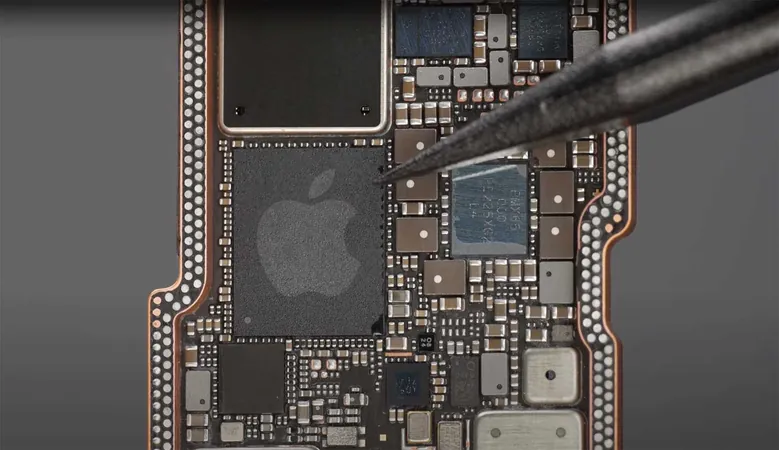

Apple has been tirelessly working for years to develop its own in-house 5G modem to reduce reliance on Qualcomm and save the substantial expenses associated with licensing its technology. The tech giant may be on the brink of a breakthrough next year with the debut of the iPhone SE 4, which is expected to be the first device featuring Apple's custom baseband chip. However, despite these efforts, Apple remains bound to its licensing agreement with Qualcomm until March 2027, as preparations to establish its own supply chain for this critical component are already in motion.

Qualcomm's Influence

While Apple seems poised to reclaim some autonomy over its 5G technology in the coming years, analysts warn that Qualcomm still holds significant power in the relationship. Industry expert Patrick Moorhead has highlighted that should Qualcomm decide to cut off Apple from its 5G modem supply, the repercussions could be devastating for the iPhone manufacturer. Though Qualcomm would likely face financial losses by terminating this lucrative relationship, the fallout for Apple could be catastrophic, leaving it frantically searching for alternative suppliers to meet the demands of its customer base.

Financial Implications

Considering the vast sums Apple pays Qualcomm for the integration of its 5G modems across various devices, it's clear how intertwined their fortunes are. Moorhead suggests that if Qualcomm were to halt shipments, Apple's stock could plummet, prompting a scramble for solutions. Yet, Qualcomm appears aware that Apple's ultimate goal is to diminish its dependency, and could potentially see an opportunity to maximize profits while the relationship still stands.

Sizable Revenues for Qualcomm

From a financial perspective, the numbers are staggering. Recent analyses indicate that Qualcomm could rake in roughly $2.52 billion from 5G modem sales alone, based on Apple's projected shipment of 90 million units for the iPhone 16 Pro Max. At a cost of approximately $28 per modem, this revenue does not only stem from the current flagship models; Qualcomm's chips are also embedded in older iPhone generations and current iPads, broadening its revenue scope.

Apple's Future Plans

As Apple gears up for its future with in-house 5G technology, it is set on outmaneuvering Qualcomm. Plans include integrating 5G functionality into upcoming iPhone models, with aspirations to roll out mmWave support for the iPhone 18 Pro and iPhone 18 Pro Max. Moreover, Apple is considering introducing cellular connectivity to its Mac lineup, a feature that may debut in an upcoming Apple Vision Pro model.

Conclusion

The future of Apple's relationship with Qualcomm remains uncertain, but one thing is clear: both companies are at a pivotal crossroads, with the potential for disruptive changes that could reshape the landscape of mobile technology. As the battle for supremacy in 5G continues, tech enthusiasts and investors alike will be watching closely to see how this high-stakes game unfolds.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)