Super Micro Stock Tumbles Despite CEO’s Reassurances on Nasdaq Delisting Fears

2024-12-11

Author: Chun

Super Micro Computer Inc. (SMCI) witnessed a staggering decline of over 9% in its stock price on Wednesday, continuing a downward spiral that began the previous day. This steep drop came despite attempts by CEO Charles Liang to alleviate concerns regarding the company's potential delisting from the Nasdaq.

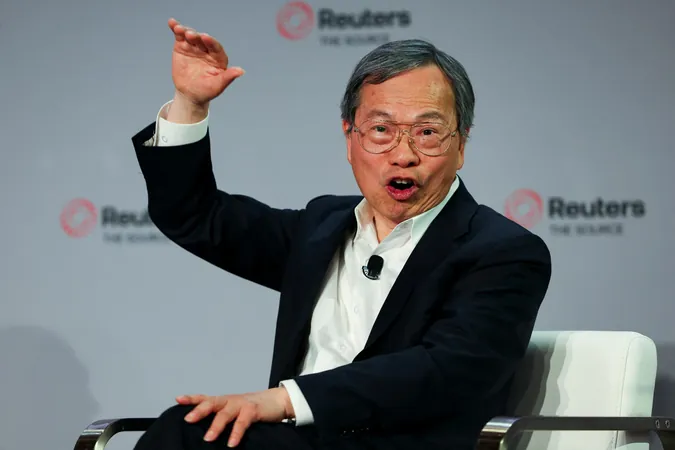

During a recent appearance at the Reuters Next conference, Liang expressed his confidence that Super Micro would meet the Nasdaq's new deadline for submitting delayed filings to the U.S. Securities and Exchange Commission (SEC). “Super Micro is dedicated to transparency and compliance with its regulators,” he assured attendees, emphasizing the company's commitment to fulfilling its obligations.

The stock's struggles began earlier in the week when JPMorgan analyst Samik Chatterjee reiterated an Underweight rating on Super Micro, which placed additional pressure on the shares. However, Chatterjee did identify some encouraging signs during his discussions with Super Micro executives. Notably, he noted that concerns about possible operational shutdowns in Malaysia had been addressed and that the company’s expansion efforts in this region would likely improve gross margins.

Chatterjee also mentioned that Super Micro's customer base remains robust, with no indications that clients are shifting their orders to competitors, despite rampant market speculation.

The company has been grappling with serious challenges following a damaging report from short-seller firm Hindenburg Research in August. The report accused Super Micro of various accounting improprieties, violating export controls, and fostering questionable relationships with its partners. As a result of these allegations, Super Micro had to delay the filing of its annual 10-K and quarterly 10-Q reports, significantly increasing the risk of delisting from the Nasdaq.

Adding to the turmoil, the Department of Justice has launched an investigation into the alleged accounting violations, and Super Micro’s accountant, Ernst & Young, resigned in late October, citing reluctance to associate with the financial statements created by the company's management. Moreover, Super Micro's fiscal first quarter earnings report, released on November 5, came in below Wall Street's expectations, deepening investors' concerns.

However, the narrative took a positive turn for Super Micro as it submitted a compliance plan to Nasdaq in late November, which sparked a massive stock rally despite these recent declines. Interestingly, even with the two days of losses, SMCI's share price remains up an impressive 65% compared to last month. The ongoing situation presents a rollercoaster of investment sentiment, leaving many analysts and investors anxiously watching the coming developments for signals about Super Micro’s future.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)