Trump's 'Sell America' Trade Wreaks Havoc on Markets: Is the Fed Next?

2025-04-21

Author: Jia

A Week to Forget for Investors

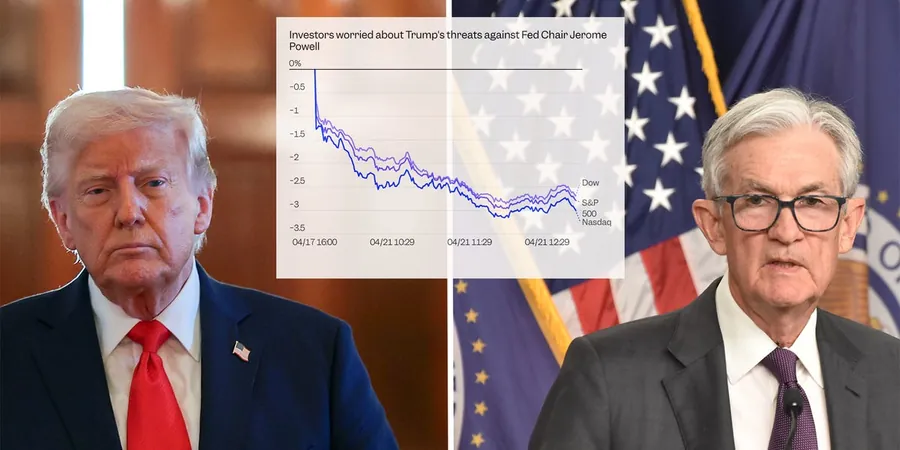

As investors kicked off the week on a grim note, the trend of 'selling America' took center stage on Monday. Stocks plummeted, bonds tanked, and the US dollar fell to a three-year low, amidst heightened tensions between President Trump and Federal Reserve Chair Jerome Powell.

Trump's Fiery Feud with the Fed

In a scathing post on Truth Social, Trump labeled Powell a "major loser" for not slashing interest rates quickly enough. This is just the latest jab in an ongoing battle, which recently saw Trump calling for Powell’s ousting due to his unwillingness to cut rates. Analysts suggest that these remarks could serve as a scapegoat narrative; if the economy slides into recession, Trump may point fingers at the Fed.

Market Mathematics: A Look at the Damage

The backlash from Trump’s comments was swift, fueling a notable sell-off across major asset classes: - **S&P 500**: 5,142.18, down 2.7% (13% YTD drop) - **Dow Jones Industrial Average**: 38,170.41, down 2.5% (10% YTD drop) - **Nasdaq Composite**: 15,870.90, down 2.6% (18% YTD drop, entering bear market territory) - **10-Year Treasury Yield**: Rose to 4.41%, up 7 basis points - **US Dollar**: Plummeted over 5% against the euro and yen, reflecting a loss of confidence

Political Turbulence and Market Uncertainty

Kevin Hassett, director of the National Economic Council, noted that Trump is considering ways to remove Powell. This political interference has investors on edge, raising questions about the Fed's independence and the potential move towards de-dollarization, indicating a waning US economic supremacy.

Tech Giants Hit Hard

The sell-off was particularly brutal for tech stocks, with icons like Tesla and Nvidia experiencing steep declines of 7% and 6%, respectively. Analysts are bracing for disappointing results from Tesla, adding to the overall uncertainty.

Bond Market Under Siege

Meanwhile, bond prices have taken a hit as yields soar amidst fears of a slowing US economy. The flight from safety that normally benefits Treasurys has been disrupted by Trump’s trade policies, foreign investor sell-offs, and mounting volatility. Investors may continue to feel skittish as Trump's attacks on Powell keep yields elevated.

A Currency in Decline

The US dollar's decline signals troubling times ahead. Capital Economics warns that the administration’s unconventional methods could further undermine both the dollar and US asset markets, contrasting earlier expectations that tariffs would bolster currency values.

Conclusion: A Rocky Road Ahead

As tensions between Trump and the Fed escalate, the market volatility raises pressing questions about the future of US economic stability. With political dynamics at play and investor confidence faltering, all eyes will be on how these developments continue to shape the landscape.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)