Unraveling Trump's Tariff Tango: What’s Next for Global Markets?

2025-04-15

Author: Wai

Global Markets Respond to Tariff Game

Investors are navigating the choppy waters of uncertainty as global markets start to stabilize. Stock prices in Asia and Europe saw a gentle rise this morning, while the dollar is showing unexpected resilience.

The Trade War Fallout

Despite the modest gains, business leaders and consumers are preparing for additional shocks stemming from President Trump’s ongoing trade conflict. This comes as China has intensified its standoff with the U.S., ordering a stoppage of new Boeing jet deliveries for Chinese airlines.

Trump’s Mixed Signals on Tariffs

In a recent announcement, Trump showcased his ‘give-and-take’ tariff strategy. He hinted at potentially exempting auto parts from tariffs, stating that they require time to revitalize U.S. manufacturing. However, he reiterated that tariffs on semiconductor chips and pharmaceuticals are still on the horizon.

Investor Sentiment Takes a Hit

The response from investors has been telling. Auto stocks saw a brief rally, but tech giant Nvidia stumbled in premarket trading, highlighting the ongoing volatility. A recent Bank of America survey revealed a record sell-off of U.S. stocks by global investors concerned about the potential for tariffs to cripple the global economy.

Concerns from Wall Street

Federal Reserve officials and CEOs are increasingly worried about economic downturns. Goldman Sachs CEO David Solomon cryptically hinted at rising recession odds during a recent earnings call, despite not directly mentioning tariffs. Nevertheless, Wall Street trading desks are capitalizing on market turbulence to clinch significant profits.

Luxury Goods Suffer

Even luxury conglomerate LVMH is feeling the pinch, reporting a drop in consumer spending among its affluent clientele. Shares took a nosedive as the company warned that trade war uncertainties might force price hikes.

Amid the Fog of Uncertainty

Atlanta Fed president Raphael Bostic remarked that businesses are enveloped in a ‘fog’ of tariff uncertainty, leading to a slowdown in economic activities.

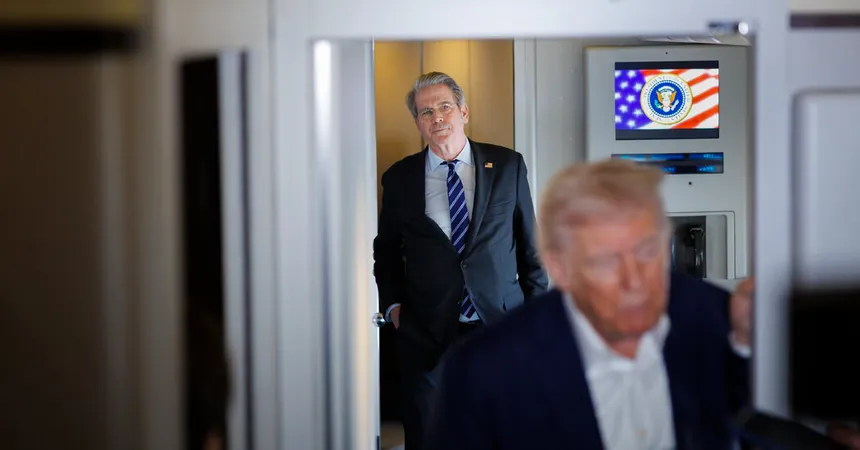

White House Optimism?

Amidst the storm, Kevin Hassett, director of the National Economic Council, attempted to downplay fears of recession. Treasury Secretary Scott Bessent also supported the Federal Reserve, asserting the administration's commitment to maintaining a ‘strong dollar’ policy.

Legal Showdown Over Tariffs

In a dramatic twist, small businesses are banding together to legally challenge Trump’s tariffs, seeking to halt his policy through the courts.

Political Intrigue and Controversies

Meanwhile, Representative Marjorie Taylor Greene’s stock trades ahead of tariff announcements have drawn scrutiny, prompting calls from Democrats for an investigation.

Higher Education vs. Trump Administration

In another ongoing feud, Harvard defied the Trump administration’s demands concerning academic freedom, receiving a harsh response with the freezing of $2.2 billion in federal grants.

Zuckerberg Testifies: Meta's Future at Stake

On the tech front, Mark Zuckerberg defended Meta during an antitrust trial, emphasizing the stiff competition from other platforms like TikTok and downplaying allegations of monopolistic practices.

The Deteriorating Dollar?

In financial markets, the U.S. dollar has dropped about 8% against other currencies since January, raising alarms about the nation’s status as a safe haven. Investors are pondering whether the ongoing turbulence is a result of global market dynamics or a deeper systemic issue.

What Lies Ahead?

While the challenges are palpable, experts believe that the U.S. economic infrastructure remains strong enough to weather the storm. However, the stakes are high as markets remain interconnected, and any significant isolationist policies could worsen the situation.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

Česko (CS)

Česko (CS)

대한민국 (KO)

대한민국 (KO)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)

الإمارات العربية المتحدة (AR)

الإمارات العربية المتحدة (AR)