Wall Street's Big Banks Bounce Back: Is a Soft Landing Inevitable?

2024-10-15

Author: Wei

Wall Street's Big Banks Bounce Back

In the third quarter of the year, major banks on Wall Street experienced a significant rebound, signaling renewed optimism in the financial sector. Corporate clients are increasingly comfortable with issuing new debt and pursuing merger opportunities. Consequently, many traders reported one of their best quarters in years.

Record Increases in Investment Banking Fees

Goldman Sachs recorded a remarkable 20% increase in investment banking fees compared to the same period last year. Meanwhile, Bank of America achieved its highest third quarter trading revenue in over ten years, and Citigroup saw its investment-banking fees soar by a staggering 44%.

Federal Reserve's Interest Rate Cuts

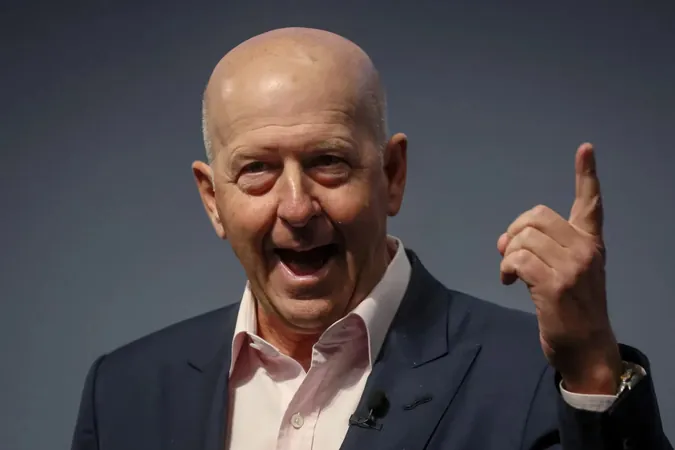

This optimistic atmosphere is largely attributed to the Federal Reserve kicking off an interest rate-cutting cycle, with a recent 50 basis point reduction in the benchmark rate. Goldman Sachs CEO David Solomon noted that conversations with clients are more constructive than ever, hinting that this rate reduction could energize economic activity. 'The beginning of the rate cut cycle has renewed optimism for a soft landing,' he stated.

CEO Insights on the Financial Landscape

Citigroup’s CEO Jane Fraser echoed this sentiment, suggesting that recent results demonstrate the bank is navigating a pivotal year successfully. Bank of America's CEO, Brian Moynihan, highlighted growth in both investment banking and asset management fees, alongside robust sales and trading revenue, solidifying confidence in the bank's recovery trajectory.

Cumulative Financial Performance

Cumulatively, investment banking fees among Goldman, Bank of America, Citigroup, and JPMorgan Chase reached $6.5 billion, marking a remarkable 27% increase year-on-year and a slight uptick from the previous quarter. Furthermore, trading revenue among these financial giants climbed to $23.4 billion, showcasing a 6% increase compared to last year.

Ongoing Challenges and Risks

However, it's worth noting that challenges persist. The continuing geopolitical unrest in the Middle East and uncertainties surrounding the upcoming 2024 US presidential election could pose significant risks to this optimism. Citigroup's CFO, Mark Mason, commented on this uncertainty, stating that geopolitical issues and election outcomes remain critical factors to monitor.

Goldman's Turnaround

Notably, Goldman has emerged from a challenging year marked by a decline in dealmaking and other struggles. Investment banking fees saw a substantial rise of 20% year-on-year, driven by increased debt and equity issuance, alongside a revival in mergers and acquisitions.

Trading Revenue Insights

As for trading, Goldman's revenue increased modestly, thanks primarily to strong performance in equities trading, although fixed-income trading revenues dropped. Conversely, Bank of America exceeded expectations with its Wall Street operations, reporting a 12% rise in trading revenue and impressive gains in equity and debt issuance.

Resilience of the US Economy

'The US economy has proven surprisingly resilient, making a hard landing less likely,' remarked Jim DeMare, President of Bank of America's global markets business, pointing toward the possibility of a 'no-landing' scenario gaining traction in economic discussions.

Citigroup's Mixed Results

While Citigroup reported a smaller-than-expected decline in net income, reflecting the contributions from investment banking, it also revealed struggles in bond trading, leading to a slight decline in stock value that day.

Investor Sentiment and Future Outlook

As Wall Street braces itself for further earnings releases, including results from Morgan Stanley, the atmosphere suggests that the two-year-long dearth of deals may finally be coming to an end. Investors remain hopeful; the question now is whether this renewed activity can sustain amidst lingering uncertainties.

Conclusion: A New Era for Wall Street?

Stay tuned, as these developments could reshape the banking landscape and influence broader economic trends. Are we witnessing the dawn of a new era for Wall Street's giants? Only time will tell!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)