What Every Retiree Must Know About Social Security Benefits in 2025: Don't Make This Common Mistake!

2024-11-24

Author: Yan

As the prospect of retirement looms, many are eager to leave the workforce and indulge in life outside the office. If you're among those contemplating retirement in the upcoming year, congratulations! You have undoubtedly earned it. However, before you dive headfirst into claiming your Social Security benefits in 2025, there's an essential piece of advice that could significantly impact your financial future: consider the timing of your claims carefully.

The Cost of Early Claims

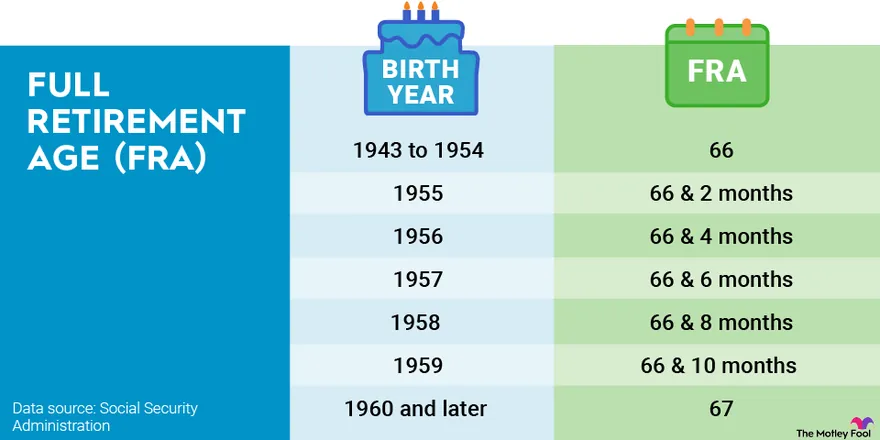

You may be eligible to start receiving Social Security benefits as early as age 62, but taking that leap prematurely could cost you dearly. If you choose to claim your benefits early, your monthly payout may be substantially lower than if you wait until your full retirement age (FRA), which varies between 66 and 67, depending on your birth year.

The implications are significant. Claiming your benefits four to five years earlier can result in a permanent reduction of 25% to 30% of your payments, putting hundreds of dollars at risk each month. As you approach your FRA, the penalties decrease, but the trade-off of a smaller check may not be worth it.

In fact, if you wait until age 70 to claim your benefits, your monthly payments can increase by an impressive 15% to 25%. This means a higher monthly income that can last throughout your retirement — a crucial factor when considering healthcare and living expenses.

What You Should Do Now

It's imperative that you reach out to the Social Security Administration, whether online, in person, or over the phone, to review your options well ahead of retirement. Doing so will help clarify whether you stand to gain from continuing to work or if claiming earlier makes more sense for you financially.

Additionally, know that after turning 70, there’s no further benefit to delaying your claim. In fact, the Social Security Administration allows only six months of retroactive benefits, so waiting longer can lead you to leave unclaimed funds behind.

Additional Considerations for Your Pre-Retirement Checklist

Beyond comparing your potential Social Security payments, there are further preparations to make. Ensure that your preferred option for receiving payments is set up — direct deposits are now the norm, eliminating paper checks altogether. Double-check that your income history with the Social Security Administration is accurate, avoiding any future payment complications due to errors.

Perhaps the most crucial element on your pre-retirement checklist involves assessing how your money will be managed post-retirement. This could involve reallocating cash in low-interest accounts to higher-yield investments or ensuring your portfolio aligns with your risk tolerance in retirement. If you are currently covered by a workplace health plan, also consider looking into Medicare supplements to enhance your healthcare coverage.

Don't Overlook this Retirement Secret!

Did you know that many retirees miss out on a substantial Social Security bonus? There are strategic moves you can employ to boost your retirement income by up to an astonishing $22,924 annually! By learning how to maximize your Social Security benefits, you can retire with the confidence and financial freedom you deserve.

Take charge of your future today by delving into these strategies! You hold the key to making the most out of your retirement; all it takes is the right information and planning. Don't wait until it's too late—start your fact-finding mission now!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)