What to Expect from Nvidia Stock in the Next Two Years: A Bright Horizon Ahead!

2024-11-29

Author: Ting

Nvidia's Market Position and Growth Prospects

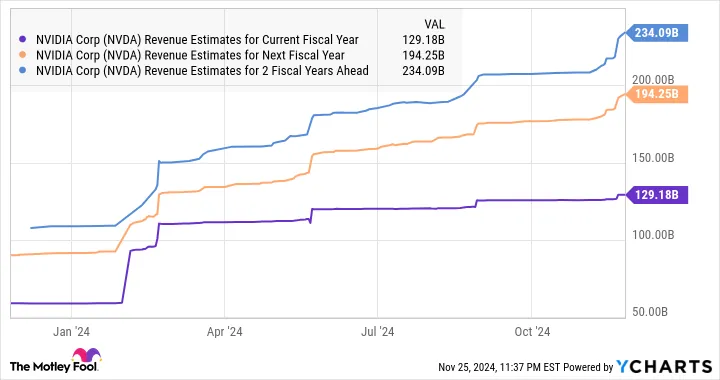

Nvidia's stock has caught the attention of investors following a recent update from Mizuho, a notable Japanese investment bank, which has raised its sales estimate for Nvidia's GPUs for 2025 by an eye-opening 10% to a total of 30 million units. This bullish outlook comes as no surprise given the burgeoning demand for graphics chips, driven not just by gaming enthusiasts but also by increasing applications in data centers and artificial intelligence (AI). Consequently, consensus projections indicate a promising growth trajectory for Nvidia in fiscal years 2025 and 2026.

Technological Advancements and Competitiveness

One of the pivotal factors behind Nvidia's stronghold in the GPU realm is its unmatched technological edge over competitors like AMD. Nvidia has decisively captured a significant portion of the AI chip market, leaving rivals scrambling to catch up. The company has laid out an aggressive product roadmap that positions it to sustain this dominance in a flourishing sector.

For example, Nvidia is planning to debut its next-generation Rubin architecture chips in the first half of 2026, succeeding the existing Blackwell processors. This shift is expected to leverage advanced manufacturing techniques, with analysts predicting the Rubin chips will be fabricated using a cutting-edge 3-nanometer (nm) process from Taiwan Semiconductor Manufacturing (TSMC). In contrast, the Blackwell chips utilize the 4NP process node—an improvement over TSMC's 5nm process. A smaller process node signifies Nvidia's ability to increase transistor density, enhancing computational power while simultaneously lowering power consumption. This advancement is likely to bolster Nvidia's competitive advantage in the AI chip market, reinforcing its robust pricing strategies.

Market Projections and Stock Valuation

As reported by AMD, the market for AI chips is projected to soar to an impressive $500 billion in revenue by 2028. Nvidia's prominent position in this industry could translate into significant growth in both revenue and profit margins. Analysts have been quick to adjust their growth expectations for Nvidia, as reflected in previous estimates.

Looking ahead, projections for fiscal 2027—which aligns with a substantial part of the calendar year 2026—are equally optimistic. Analysts anticipate that Nvidia will achieve earnings of $5.55 per share for fiscal 2027. Assuming the stock trades at a multiple of 40.8 times earnings, which mirrors its five-year average forward earnings ratio, we could see Nvidia's stock price reaching approximately $226 per share in a couple of years. That would signify a remarkable 67% increase from its current valuation.

Currently, Nvidia is trading at 36 times forward earnings, presenting an appealing opportunity for investors looking to add a tech stock with substantial growth potential to their portfolios. With Nvidia's future looking incredibly bright, savvy investors are urged not to overlook this attractive entry point. The company's solid growth track record lends credence to enhanced market valuations, and stronger gains for Nvidia seem plausible if the market acknowledges its growth trajectory.

Investment Consideration: Is Nvidia Worth $1,000?

Before you make any investment decisions, it's essential to weigh your options against other potential opportunities. Notably, the Motley Fool Stock Advisor team recently identified ten stocks they deem the best buys for investors today—and surprise! Nvidia isn't one of them. These ten stocks hold the promise of delivering extraordinary returns in the upcoming years.

Reflecting on past performance, if you had invested $1,000 in Nvidia when it first appeared on the Motley Fool Stock Advisor list back on April 15, 2005, your investment would have skyrocketed to an astounding $829,378! With proven strategies for success and timely stock recommendations, the Stock Advisor service has significantly outperformed the S&P 500 since its inception in 2002.

Conclusion

In conclusion, while Nvidia's prospects certainly appear bright, the market is full of possibilities, and careful consideration should guide your investment decisions. Stay informed and make the moves that align best with your financial goals!

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)