XRP Surges Past Tether to Claim 3rd Largest Cryptocurrency Spot; Bitcoin Confronts $384M Sell Wall

2024-12-02

Author: Yan

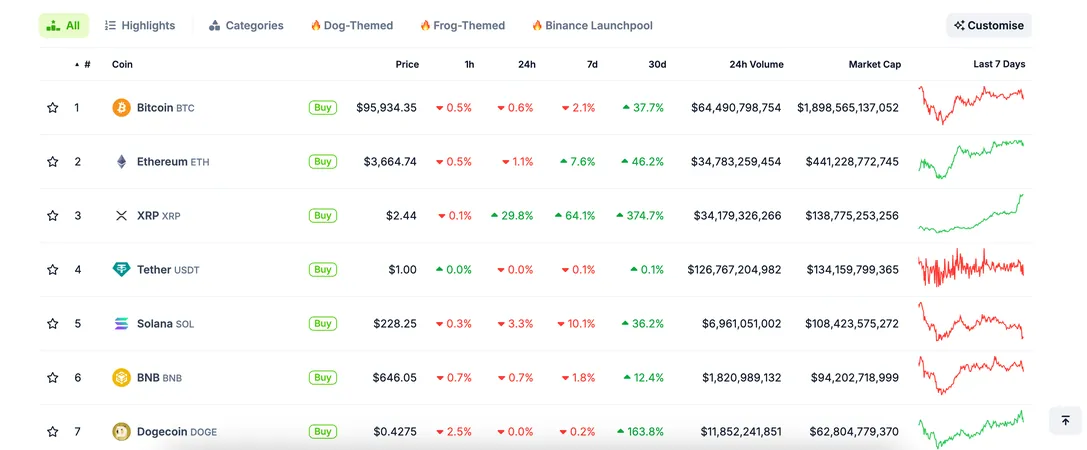

In a surprising twist in the cryptocurrency market, XRP has officially surpassed Tether (USDT) as the third largest cryptocurrency, showcasing a staggering rise of 375% in just 30 days and reaching a price of $2.40. This remarkable surge over the past 24 hours alone—resulting in a 20% price increase—has propelled XRP's market capitalization to an impressive $139 billion.

The resurgence of XRP is not just a fluke; it's indicative of a broader trend in crypto trading. Mena Theodorou, co-founder of the crypto exchange Coinstash, suggests that this rapid comeback could be signaling the renewal of interest among retail traders and investors. Factors such as trending content on TikTok, speculation surrounding a potential stablecoin issued by Ripple, and ongoing discussions around Exchange-Traded Funds (ETFs) are believed to be driving significant interest toward XRP.

Trading activity has seen remarkable spikes, particularly on South Korea’s largest crypto exchange, Upbit, which recorded unbelievable trading volume amounts. In the last day alone, XRP's trading volumes reached $4 billion when paired with the Korean won, accounting for more than 27% of Upbit's total trades, according to Coingecko.

Compounding these developments, the Democratic Party in South Korea announced a delay on plans to impose a crypto capital gains tax, initially slated for 2021 but now pushed back to 2027. This extended timeline is expected to invigorate speculative trading, as outlined by Markus Thielen, founder of 10x Research, who emphasized that this decision removes a critical barrier for traders eager to capitalize on volatile markets.

Meanwhile, Bitcoin (BTC), while still the market leader, finds itself grappling with a formidable sell wall amounting to $384 million. Currently trading at $96,000, Bitcoin has faced pressure, hovering in the $90,000 to $100,000 range without securing upward momentum for a breakthrough. According to analyst Valentin Fournier from BRN, Bitcoin's psychological resistance at the $100,000 mark is palpable, noting substantial profit-taking and a pressing need to clear over 4,000 BTC in sell orders to advance further.

Moreover, Bitcoin's dominance within the crypto market is waning, dropping from 61.5% to 56.5% since late November, indicating a shift in investor focus towards alternative cryptocurrencies or altcoins. This market realignment could set the stage for an exciting phase in the cryptocurrency landscape as confidence in BTC's upward trajectory continues to waver.

In the coming days, as XRP maintains its remarkable rise and Bitcoin struggles to reclaim its position, the dynamics within the cryptocurrency market promise to be both captivating and unpredictable. Are we witnessing the dawn of a new era in crypto trading? Only time will tell, but the ongoing shifts are sure to be closely watched by traders and investors alike.

Brasil (PT)

Brasil (PT)

Canada (EN)

Canada (EN)

Chile (ES)

Chile (ES)

España (ES)

España (ES)

France (FR)

France (FR)

Hong Kong (EN)

Hong Kong (EN)

Italia (IT)

Italia (IT)

日本 (JA)

日本 (JA)

Magyarország (HU)

Magyarország (HU)

Norge (NO)

Norge (NO)

Polska (PL)

Polska (PL)

Schweiz (DE)

Schweiz (DE)

Singapore (EN)

Singapore (EN)

Sverige (SV)

Sverige (SV)

Suomi (FI)

Suomi (FI)

Türkiye (TR)

Türkiye (TR)